RCM

Why Your Claims Are Being Denied Proven Ways to Resolve It

Every month, healthcare practices leave millions of dollars on the table not because they didn’t earn it, but because their claims aren’t getting paid. If you’re tired of watching your accounts receivable grow while your bank account stays the same, you’re not alone.

The statistics are staggering. Healthcare practices face denial rates between 5-10% on average, with some experiencing rates as high as 20%. Each denied claim costs $25-$40 in administrative expenses to research, correct, and resubmit. For a practice submitting 1,000 claims monthly, even a 10% Denial rate means $2,500-$4,000 in additional costs – before considering the delayed cash flow impact.

The good news? Most claim payment issues stem from preventable problems that can be identified, corrected, and systematically avoided with the right revenue cycle management strategies. Whether you’re dealing with eligibility issues, documentation problems, or coding errors, there are proven solutions that can transform your medical billing RCM process.

This comprehensive guide examines the five most common reasons claims get denied or delayed, plus actionable solutions to fix each issue and prevent future problems. By implementing these strategies, you’ll improve your clean claim rate, accelerate payments, and strengthen your practice’s financial health.

When Insurance Says "Who?" - Fixing Eligibility and Coverage Issues

Eligibility and coverage problems represent the single largest category of preventable claim denials, accounting for 20-30% of all rejections in practices without systematic verification processes. These denials are particularly frustrating because they’re entirely avoidable with proper RCM in medical billing protocols.

The Root Causes

Outdated insurance information sits at the heart of most eligibility denials. Patients change jobs, switch plans, or lose coverage, but practices often rely on information collected months or years ago. When claims hit inactive policies, they bounce back immediately, creating delays that can stretch payment cycles by 30-60 days.

Missing or incorrect subscriber information creates another common stumbling block. Insurance cards may show a spouse’s name as the subscriber, but claims get submitted under the patient’s name. Different insurance ID numbers for family members compound this problem, especially in pediatric practices where parents frequently switch children between different policies.

Coordination of benefits issues multiply when patients have multiple insurance policies. Without proper primary and secondary insurance identification, claims get rejected or payments get delayed while payers determine responsibility.

Eligibility-related denials don’t just delay payments, they create cascading administrative costs. Staff must research each denial, contact patients for updated information, verify new coverage, and resubmit claims. This process typically takes 15-30 minutes per claim, adding significant labor costs to what should be routine transactions.

The cash flow impact compounds these direct costs. A claim denied for eligibility issues today won’t be paid for another 30-45 days after correction and resubmission. For practices operating on thin margins, these delays can create serious cash flow problems.

Systematic Solutions

Real-time eligibility verification at every patient touchpoint eliminates most coverage-related denials. Modern RCM systems can check eligibility when appointments are scheduled, during patient check-in, and immediately before services are provided. This three-point verification catches coverage changes before they become expensive problems.

Automated eligibility verification tools integrate with practice management systems to streamline the verification process. These tools check coverage, benefits, copayments, and prior authorization requirements in seconds, providing staff with real-time information needed for accurate claim submission.

Patient information update protocols ensure that demographic and insurance changes are captured and verified. Simple processes like asking patients to confirm their information at each visit and requiring patients to present insurance cards can prevent many eligibility issues.

Training front desk staff on proper verification procedures includes teaching them to recognize red flags like expired insurance cards, mismatched names and addresses, or patients who seem uncertain about their coverage details.

Documentation deficiencies represent another major category of claim denials that directly impact healthcare revenue cycle management. When clinical documentation doesn’t support the services billed, payers reject claims or request additional information, creating delays and administrative burden.

Common Documentation Failures

Insufficient clinical documentation to support services billed leads to medical necessity denials. Payers increasingly scrutinize claims to ensure that services provided were appropriate and necessary for the patient’s condition. Without adequate documentation, even legitimate services may be denied.

Missing or inadequate medical necessity justification occurs when providers fail to clearly document why specific services were required. A routine procedure without documented symptoms or indications for treatment will likely face medical necessity challenges.

Incomplete treatment plans and progress notes create gaps in the clinical narrative that payers use to evaluate claims. When documentation doesn’t tell a complete story of the patient’s condition and treatment, claims reviewers may question the appropriateness of services.

Failure to document complications, comorbidities, or additional diagnoses that justify more complex or extensive services leads to downcoding or denials. These documentation gaps can significantly impact reimbursement levels.

The Coding Connection

Poor documentation directly leads to coding errors because coders can only assign codes based on what’s documented in the medical record. Incomplete or vague documentation forces coders to choose less specific codes that may not accurately reflect the complexity of services provided.

The impact on reimbursement levels can be substantial. The difference between a level 3 and level 4 evaluation and management code may be $50-100 or more, depending on the payer. Multiply this across hundreds of encounters annually, and documentation deficiencies can cost practices tens of thousands of dollars.

Audit risks increase when documentation doesn’t support the codes billed. Post-payment audits may result in recoupments, penalties, and increased scrutiny of future claims.

Documentation templates and guidelines help providers create comprehensive, consistent records that support appropriate coding and billing. Templates should be specialty-specific and include prompts for key elements that support medical necessity and coding requirements.

Clinical documentation improvement programs provide ongoing education and feedback to help providers enhance their documentation practices. These programs typically include regular chart reviews, individualized feedback, and education on documentation requirements for different service types.

Provider training on documentation requirements should be ongoing, not just a one-time event. Revenue cycle management success depends on providers’ understanding of how their documentation directly impacts practice revenue and compliance.

Documentation review protocols before claim submission can catch deficiencies before they become denials. Some practices implement coding and documentation review processes that identify potential issues while there’s still time to obtain additional information from providers.

Clinical decision support tools integrated into electronic health records can guide documentation by providing real-time prompts and suggestions based on the patient’s condition and services provided.

Getting Permission First - Mastering Prior Authorization Requirements

Prior authorization requirements have exploded across all medical specialties, creating new challenges for RCM medical billing processes. Failure to obtain required authorizations is among the most costly types of claim denials because the entire claim value may be at risk.

Authorization Challenges

Different requirements across multiple payers create a complex web of authorization rules that change frequently. What requires authorization from one payer may be routine for another. Keeping track of these requirements manually is nearly impossible for busy practices.

Incorrect or incomplete authorization requests delay approvals and can result in denials even when authorization is eventually obtained. Each payer has specific forms, required information, and submission processes that must be followed precisely.

Expired or modified authorizations catch many practices off guard. Authorizations may have specific date ranges, visit limits, or service restrictions that aren’t always clearly communicated when the authorization is initially approved.

Specialty-specific authorization complexities vary widely. Some procedures require multiple approvals, step therapy documentation, or specialist referrals before authorization will be grante

The Complexity Factor

Managing authorizations across multiple payers, providers, and service types requires systematic processes that many practices lack. Authorization requirements change frequently, and staying current with these changes requires dedicated resources.

Healthcare RCM systems must accommodate the varying timelines, documentation requirements, and approval processes that different payers use. Some authorizations are approved within hours, while others may take weeks.

Strategic Solutions

Payer-specific authorization tracking systems help practices stay current with changing requirements and manage pending authorization requests. These systems should track authorization status, expiration dates, and any restrictions or limitations.

Authorization verification workflows ensure that required approvals are obtained before services are scheduled or provided. These workflows should include regular checks for authorization status and alerts when authorizations are approaching expiration.

Dedicated authorization staff or processes may be necessary for practices that frequently require authorizations. These staff members can develop expertise in payer requirements and build relationships with payer representatives to expedite approvals.

Authorization management software tools can automate many aspects of the authorization process, from initial request submission to status tracking and renewal management.

Payer relationship management strategies include regular communication with payer representatives to understand policy changes, streamline approval processes, and resolve authorization issues quickly.

Getting the Codes Right - Eliminating Coding and Billing Errors

Coding and billing errors remain a persistent source of claim denials despite advances in revenue cycle management technology. These errors range from simple data entry mistakes to complex coding compliance issues that require specialized knowledge to prevent.

Incorrect ICD-10 diagnostic codes occur when diagnoses are coded too broadly, too specifically, or simply wrong. With over 70,000 available codes, choosing the most accurate and specific code requires both clinical knowledge and coding expertise.

Wrong or unbundled CPT procedure codes happen when services are coded separately that should be billed together, or when more complex procedures are broken down into component parts. Understanding bundling rules and proper code sequencing is essential for compliance and optimal reimbursement.

Improper modifier usage or missing modifiers can dramatically impact claim processing. Modifiers provide additional information about how, when, or where services were provided. Using the wrong modifier or omitting a required modifier can result in denials or incorrect payments.

Upcoding and downcoding issues arise when the codes selected don’t accurately reflect the complexity or extent of services provided. Both scenarios create problems: upcoding raises compliance concerns, while downcoding leaves money on the table.

Billing Process Problems

Incorrect patient demographic information, wrong provider information, or incorrect NPI numbers create immediate claim rejections that are easily preventable with proper data verification processes.

Date of service errors, duplicate claim submissions, and other billing process mistakes often stem from manual processes or inadequate quality control procedures.

Systematic Solutions

Ongoing coding education and certification ensure that coding staff stay current with code updates, rule changes, and payer-specific requirements. Medical billing RCM success requires continuous learning as coding rules constantly evolve.

Claim scrubbing software with real-time edits can catch many coding and billing errors before claims are submitted. These systems check claims against thousands of coding rules and payer requirements, flagging potential problems for review.

Coding review and audit processes provide quality control and continuous improvement opportunities. Regular internal audits can identify patterns of errors and training needs before they become widespread problems.

Clear coding guidelines and protocols help ensure consistency across different coders and providers. These guidelines should be updated regularly and communicated to all relevant staff.

Encoder software with built-in compliance checks helps coders select appropriate codes while avoiding common errors. Modern encoders include edit checks, bundling rules, and medical necessity guidelines.

Beat the Clock - Managing Timely Filing Requirements

Timely filing requirements create hard deadlines that can turn collectible claims into permanent write-offs. Each payer has different filing deadlines, ranging from 90 days to one year from the date of service. Missing these deadlines can cost practices thousands of dollars in lost revenue.

Timing Challenges

Payer-specific filing deadlines vary widely and change periodically. Medicare may allow one year for filing, while some commercial payers require submission within 90 days. Keeping track of these requirements across multiple payers requires systematic processes.

Delays in claim preparation and submission often result from inefficient workflows, manual processes, or staff shortages. What should be a routine daily task can become a monthly crisis when proper systems aren’t in place.

Resubmission timing for corrected claims and appeal deadline management adds additional layers of complexity. Corrected claims may have shorter filing deadlines than original claims, and appeal deadlines are typically much shorter than original filing deadlines.

Process Breakdowns

Inefficient claim processing workflows create bottlenecks that delay submission. When claims sit in various stages of processing for extended periods, the risk of missing filing deadlines increases dramatically.

Manual processes that create delays include paper-based workflows, manual data entry, and lack of automation in routine tasks. These processes not only increase the risk of timing errors but also consume valuable staff time.

Poor tracking of claim submission dates makes it difficult to identify claims approaching filing deadlines. Without systematic tracking, practices may not realize they have timing issues until it’s too late.

Time Management Solutions

Automated claim submission schedules ensure that claims are processed and submitted consistently without waiting for manual intervention. RCM systems can be configured to submit claims daily or weekly according to practice preferences.

Filing deadline tracking systems monitor claim status and alert staff when claims are approaching filing deadlines. These systems should account for weekends, holidays, and payer-specific business practices.

Electronic claim submission dramatically reduces processing time compared to paper submissions. Electronic claims are typically processed within 24-48 hours, while paper claims may take weeks.

Systematic resubmission and appeal processes ensure that corrected claims and appeals are handled promptly and tracked appropriately. These processes should include specific timelines and responsibilities for each type of claim follow-up.

Your Roadmap to Payment Success - Implementing Systematic Solutions

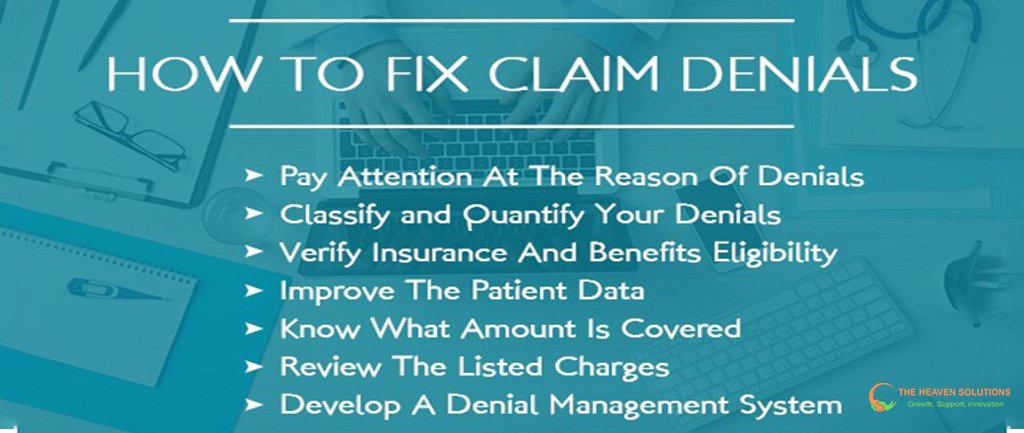

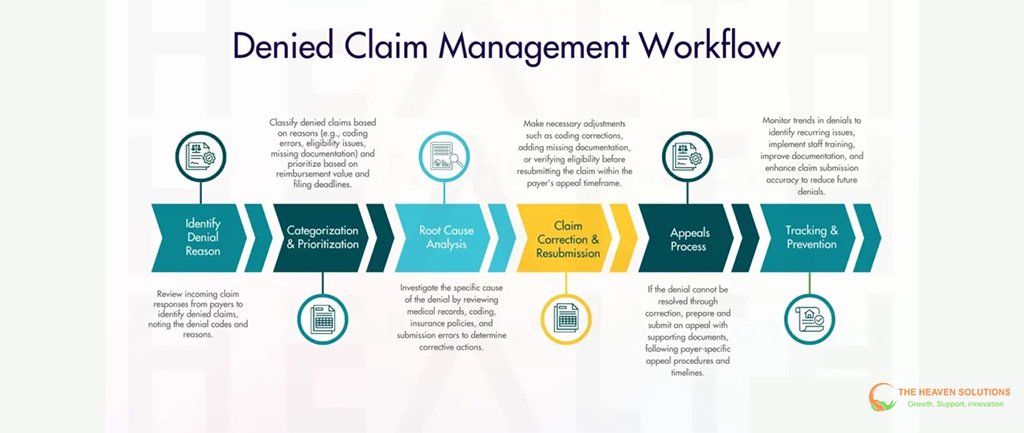

Fixing claim payment problems requires a systematic approach that addresses root causes rather than just symptoms. The most successful practices follow a three-phase implementation strategy that creates sustainable improvements in revenue cycle optimization.

Phase 1: Diagnostic Assessment

Comprehensive claims analysis identifies the specific denial reasons affecting your practice. This analysis should examine at least six months of denial data to identify patterns and trends. The analysis should categorize denials by type, payer, provider, and service category to pinpoint the highest-impact opportunities for improvement.

Current workflow analysis identifies bottlenecks and inefficiencies that contribute to claim problems. This assessment should map the entire claims process from patient registration through final payment, identifying where delays and errors commonly occur.

The technology capability review evaluates whether current systems support efficient claims processing or create additional problems. This review should assess integration capabilities, automation features, and reporting functionality.

Staff training needs assessment identifies knowledge gaps that contribute to claim problems. This assessment should evaluate both technical skills and understanding of payer requirements and compliance issues.

Phase 2: Strategic Implementation

Prioritizing fixes based on financial impact and implementation complexity ensures that limited resources are focused on the highest-value improvements first. Quick wins that show immediate results build momentum for larger changes.

Technology solutions for automation and accuracy can eliminate many manual processes while improving consistency and reducing errors. Healthcare revenue cycle management systems provide integrated platforms that streamline workflows and reduce administrative burden.

Workflow redesign eliminates bottlenecks and redundancies while building quality control checkpoints into routine processes. New workflows should be documented and communicated clearly to all staff members.

Quality control and review processes catch errors before they become expensive problems. These processes should be built into daily workflows rather than treated as occasional audit activities.

Phase 3: Monitoring and Optimization

Key performance indicator tracking provides ongoing visibility into claims process performance. Important metrics include clean claim rate, Denial rate, days in accounts receivable, and first-pass resolution rate.

Regular claims analysis and trend monitoring help identify new problems before they become widespread issues. Monthly analysis of denial data can reveal emerging patterns that require attention.

Ongoing staff training and education ensure that improvements are sustained and that staff stay current with changing requirements. Revenue cycle management success requires continuous learning and adaptation.

Process refinement based on performance data ensures that improvements continue over time. What works well should be strengthened, while persistent problems require additional attention and resources.

Stay Ahead of the Game - Prevention Strategies That Work

Prevention is always more cost-effective than fixing problems after they occur. Practices that build robust prevention strategies into their RCM processes consistently outperform those that rely on reactive problem-solving.

Proactive Quality Controls

Pre-submission claim scrubbing and validation catch errors before they reach payers. Modern revenue cycle management systems include sophisticated editing capabilities that check claims against thousands of rules and requirements.

Regular audit and compliance reviews identify potential problems before they become widespread issues. These reviews should be conducted by qualified professionals who understand both coding requirements and payer policies.

Staff competency assessments and training ensure that team members have the knowledge and skills needed to perform their roles effectively. Training should be ongoing and specific to each role’s requirements.

Technology updates and system maintenance keep RCM systems running efficiently and ensure that editing rules and payer requirements are current.

Performance Monitoring

Key metrics tracking provides early warning signals when performance begins to decline. Important metrics should be monitored daily or weekly, not just monthly or quarterly.

Trend analysis and early warning systems help identify problems before they significantly impact cash flow. For example, a gradual increase in Denial rate may indicate training needs or process problems that require attention.

Benchmarking against industry standards provides context for practice performance and helps identify improvement opportunities. Healthcare RCM benchmarks are available from various industry sources and can guide goal-setting and performance evaluation.

Regular performance reviews and improvement planning ensure that revenue cycle optimization remains a priority and that new challenges are addressed promptly.

Transform Your Claims Process Today

Understanding why your claims aren’t being paid is the first step toward resolving the issue. The five major categories of claim denials, eligibility issues, documentation problems, authorization failures, coding errors, and timing problems can all be prevented with proper processes, training, and technology.

The systematic approach outlined in this guide provides a roadmap for sustainable improvement. By conducting a thorough diagnostic assessment, implementing strategic solutions, and maintaining ongoing monitoring and optimization, practices can dramatically improve their financial performance.

Success metrics are clear and achievable. Practices that implement comprehensive revenue cycle management strategies typically achieve clean claim rates above 95%, denial rates below 5%, and days in accounts receivable between 30 and 40 days. These improvements translate directly to improved cash flow, reduced administrative costs, and enhanced profitability.

The key insight is that most claim payment problems are entirely preventable. With proper RCM in medical billing processes, advanced technology solutions, and ongoing staff development, practices can eliminate the vast majority of claim denials while accelerating payments and reducing administrative burden.

Ready to stop leaving money on the table and start getting paid faster? Contact The Heaven Solutions today for a comprehensive claims analysis and customized improvement plan. Our proven methodologies have helped hundreds of practices reduce denial rates by 60% while improving collection rates above 95%.

Don’t let preventable claim issues drain your profitability. Take action today and transform your revenue cycle performance. Your practice’s financial future depends on getting claims paid promptly and consistently. The solutions exist, the technology is available, and the results are proven. The only question is when you’ll start implementing them.