RCM

Ultimate Guide to Growing Healthcare Revenue Predictably: The Art of Claims Submission and Follow-Up

What’s Included

Featured Post

The Top Denial Reasons by Insurance Payers and How to Boldly Outsmart Them

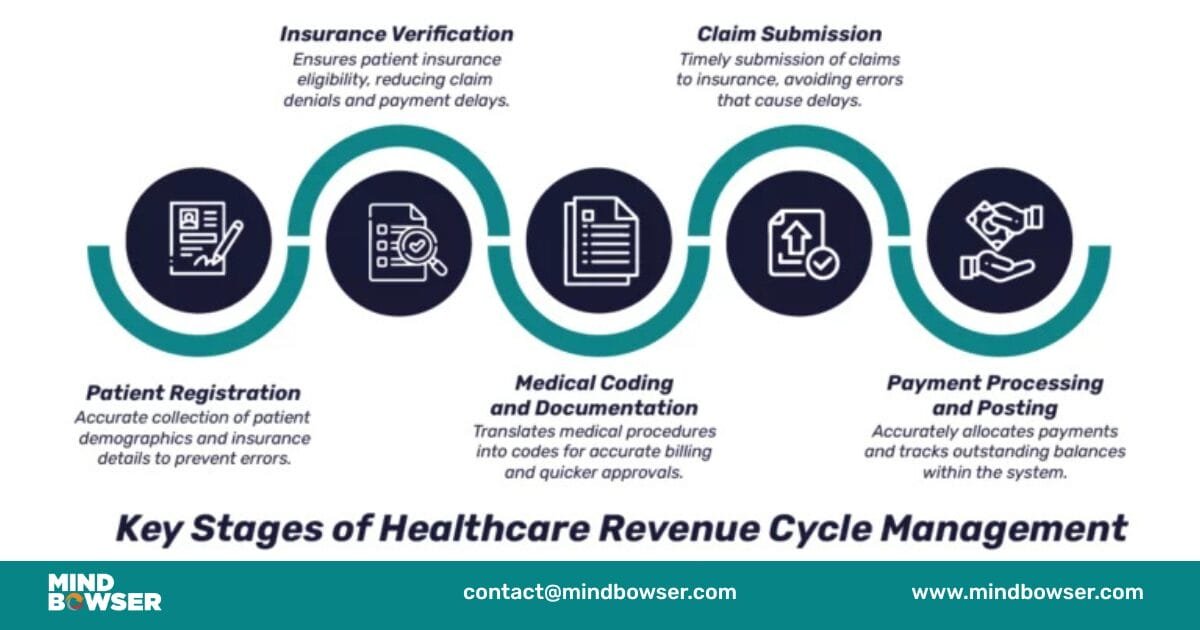

Healthcare practices that master the art of claims submission and follow-up don’t just get paid faster – they transform their entire financial operations from chaotic cash flow struggles into predictable revenue engines. While many practices treat RCM in medical billing as a necessary evil, the most successful ones understand it’s both a science and an art form.

Mastering claims submission and follow-up combines strategic processes, advanced technology, and skilled execution to achieve consistent, accelerated payments. When you understand what RCM is and implement proven methodologies, you create a financial masterpiece that generates predictable revenue while reducing administrative burden.

This comprehensive guide explores the artistic elements of healthcare revenue cycle management, revealing how top-performing practices achieve 95%+ clean claim rates and collect payments in 14-21 days through methodical excellence. You’ll discover the techniques that separate amateur billing operations from true revenue cycle artists.

Painting Your Financial Success: The Essential Elements of Claims Mastery

Understanding what RCM means in healthcare starts with recognizing the current challenges facing healthcare practices. Industry statistics reveal that claim denial rates average 5-10%, with some practices experiencing rates as high as 20%. Each denied claim costs $25-$40 in administrative expenses to research, correct, and resubmit – not including the cash flow impact of delayed payments.

The financial impact of inefficient claims processes extends far beyond direct costs. When claims take 60-90 days to collect instead of 14-21 days, practices must finance operations while waiting for payments. This hidden financing cost – whether through bank loans, credit lines, or delayed vendor payments – erodes profitability and limits growth opportunities.

The rising complexity of payer requirements and regulatory compliance adds another layer of challenge. RCM systems must accommodate varying documentation requirements, prior authorization processes, and billing rules across dozens of different payers. Manual processes simply cannot keep pace with these evolving requirements.

The Art vs. Science of Claims Management

The technical precision requirements represent the “science” of medical billing RCM. Claims must contain accurate patient demographics, correct insurance information, proper coding, and complete documentation. Missing or incorrect information triggers immediate rejections that delay payments and increase administrative costs.

Strategic timing and relationship management represent the “art” of RCM medical billing. Knowing when to submit claims for optimal processing, how to communicate effectively with payer representatives, and which follow-up strategies work best with different payers requires experience and skill that technology alone cannot provide.

Integration of human expertise with technology solutions creates the perfect combination for revenue cycle optimization. Advanced RCM revenue cycle management systems provide the tools, but skilled staff must use them strategically to achieve optimal results.

Defining Claims Excellence

Key performance indicators that separate masters from amateurs include clean claim rates above 95%, denial rates below 5%, days in accounts receivable under 40, and net collection rates above 97%. These benchmarks represent the difference between struggling practices and financial success stories.

Industry benchmarks show that top-performing practices collect 15-25% more revenue than average practices, not because they provide more services, but because they master the fundamentals of healthcare RCM. They understand that every claim represents both an art piece and a business transaction.

ROI analysis of investing in claims process optimization shows returns of 300-500% within the first year. A practice generating $2 million annually can see additional collections of $200,000-400,000 through improved revenue cycle management, while reducing administrative costs by 20-30%.

Strategic timing and relationship management represent the “art” of RCM medical billing. Knowing when to submit claims for optimal processing, how to communicate effectively with payer representatives, and which follow-up strategies work best with different payers requires experience and skill that technology alone cannot provide.

Integration of human expertise with technology solutions creates the perfect combination for revenue cycle optimization. Advanced RCM revenue cycle management systems provide the tools, but skilled staff must use them strategically to achieve optimal results.

Before the First Brushstroke: Crafting Perfect Claims from the Start

What RCM is in healthcare becomes clear when you understand that masterpieces are created through preparation, not luck. Pre-submission excellence eliminates 80% of common denial reasons while reducing administrative burden throughout your organization.

Patient Access and Information Verification

Real-time eligibility verification strategies prevent the most common category of claim denials – coverage and eligibility issues. Modern RCM systems check eligibility when appointments are scheduled, during patient check-in, and immediately before services are provided. This three-point verification catches coverage changes, policy cancellations, and benefit limitations before they cause expensive problems.

Demographic data accuracy protocols ensure that patient names, addresses, dates of birth, and insurance ID numbers match exactly what’s on file with insurance companies. Simple typos in any field trigger immediate claim rejections. Systematic verification procedures include asking patients to confirm information at each visit and requiring current insurance cards.

Prior authorization management and documentation requirements vary by payer and service type. Healthcare revenue cycle management systems must track authorization status, expiration dates, and renewal requirements across multiple payers. Missing or expired authorizations can invalidate entire claims, making this verification critical.

Insurance benefit confirmation and patient financial counseling go beyond simple eligibility checking. Patients need to understand their deductibles, copayments, and out-of-network penalties upfront. This transparency improves patient satisfaction while ensuring accurate financial responsibility calculation.

Clinical Documentation as Your Medium

Medical necessity documentation standards require providers to document not just what they did, but why it was necessary for the patient’s condition. RCM management success depends on comprehensive clinical documentation that supports every service billed. Without proper documentation, even legitimate services may face medical necessity denials.

Integration between clinical workflows and billing processes eliminates duplicate data entry while ensuring accurate information flow. Medical revenue cycle management systems must connect electronic health records with practice management platforms to streamline operations and reduce errors.

Provider education on the documentation impact on reimbursement helps clinical staff understand how their notes directly affect practice revenue. Many providers don’t realize that incomplete documentation can cost thousands of dollars in denied or downcoded claims.

Quality assurance checkpoints and review protocols catch documentation deficiencies before claims are submitted. Regular chart reviews and feedback help providers improve their documentation while identifying systematic issues that need attention.

Coding Precision and Compliance

ICD-10 and CPT coding accuracy standards require ongoing education as codes and rules change annually. RCM cycle in medical billing success depends on staying current with these updates while understanding complex relationships between diagnosis and procedure codes.

Modifier usage guidelines and bundling rule compliance prevent common errors that result in claim denials or reduced payments. Understanding when modifiers are required and how bundling rules apply requires specialized knowledge and attention to payer-specific policies.

Technology-assisted coding tools and validation systems help coders select appropriate codes while avoiding common errors. Modern RCM software includes edit checks that verify code relationships, medical necessity, and compliance with bundling rules before claims are submitted.

Regular audit processes and continuous improvement protocols identify patterns of errors and opportunities for additional training. Healthcare RCM requires systematic monitoring of coding accuracy and proactive correction of identified issues.

The Perfect Stroke: Advanced Submission Strategies for First-Pass Success

Mastering the submission process requires understanding technical requirements, timing considerations, and payer relationships that determine processing success. Revenue cycle management in healthcare becomes an art when you perfect these execution elements.

Electronic Submission Mastery

EDI standards and electronic claim formatting best practices ensure that claims are processed quickly and accurately. Electronic Data Interchange transactions use standardized formats that payers can process automatically. RCM billing systems must support standard transaction types, including 837P (professional claims), 837I (institutional claims), and various inquiry and response transactions.

Clearinghouse relationships and portal management optimization provide multiple pathways for claim submission. Some payers require specific clearinghouses or portal submission for certain claim types. Managing these relationships and requirements adds complexity but ensures optimal processing.

Batch processing strategies versus real-time submission decisions depend on practice size, cash flow needs, and administrative capacity. Daily batch submission provides optimal cash flow timing, while real-time submission may be appropriate for urgent claims or practices with limited administrative staff.

Technology integration for seamless workflow automation eliminates manual steps that create delays and introduce errors. Revenue cycle management systems can move claims through various approval stages and submit them automatically according to predetermined schedules.

Timing and Workflow Orchestration

Optimal submission schedules for different payer types and claim categories maximize processing speed while accommodating payer preferences. Some payers process claims faster on certain days of the week or times of the month. Understanding these patterns helps optimize timing.

Quality control checkpoints and final validation protocols ensure claims meet all requirements before submission. These systematic reviews should include verification of patient demographics, insurance information, coding accuracy, and documentation completeness.

Staff training and responsibility assignment ensure consistent submission processes regardless of who’s handling the work. Clear protocols and backup procedures prevent submission delays when key staff members are unavailable.

Performance monitoring and real-time submission tracking provide immediate feedback on submission success. Medical billing RCM systems should generate confirmation reports that verify claims were received and accepted by payers or clearinghouses.

Payer Relationship Management

Understanding unique payer requirements and preferences prevents rejections and delays. Commercial payers may have different requirements than government payers, and specialty services may face additional scrutiny or documentation requirements.

Building strategic partnerships with key payer representatives facilitates problem resolution and provides advance notice of policy changes. Regular communication with payer contacts helps practices stay current with changing requirements and resolve issues quickly.

Proactive communication strategies and issue resolution protocols ensure that problems are addressed before they impact multiple claims. RCM services should include systematic payer relationship management as a core component.

Adapting to changing payer policies and industry trends requires ongoing monitoring and adjustment of processes. Healthcare revenue cycle management systems must be flexible enough to accommodate new requirements without disrupting existing workflows.

The Finishing Touches: Strategic Follow-Up That Converts Claims to Cash

Strategic follow-up transforms submitted claims into collected revenue through systematic tracking and professional payer communication. Understanding what revenue cycle management is includes recognizing that submission is just the beginning – follow-up determines whether claims get paid promptly or age indefinitely.

Sophisticated Tracking and Monitoring Systems

Aging report analysis and priority classification strategies optimize staff time and effort. Claims should be prioritized based on dollar amount, payer type, claim age, and likelihood of successful collection. Revenue cycle management in healthcare requires strategic resource allocation to maximize results.

Automated alert systems and escalation protocols ensure no claims fall through tracking gaps. RCM systems should automatically generate follow-up lists and alerts when claims reach predetermined age thresholds. These systems prevent claims from aging without appropriate attention.

Performance dashboards and real-time visibility tools provide management with current status on key metrics, including days in accounts receivable, denial rates, and collection performance. Healthcare revenue cycle management requires data-driven decision-making supported by comprehensive reporting.

Predictive analytics for proactive claim management identifies patterns that help prevent problems before they occur. Advanced RCM management systems can analyze historical data to predict which claims are likely to encounter problems and suggest preventive actions.

Professional Payer Communication Techniques

Phone follow-up scripts and best practices help staff gather needed information efficiently while maintaining professional relationships. Effective communication requires preparation, persistence, and professionalism. Staff should have complete claim information available and understand payer-specific procedures before making calls.

Electronic inquiry systems optimization using 270/271 transactions provides automated claim status checking that’s faster and more accurate than phone calls. Medical revenue cycle management systems can submit these inquiries automatically and process responses to update claim status in real-time.

Written correspondence strategies for complex issues and appeals ensure that written inquiries are professional, complete, and persuasive. Templates and standard procedures help maintain consistency while allowing customization for specific situations.

Relationship-building techniques with payer representatives create partnerships that facilitate problem resolution. Regular, professional communication builds trust and understanding that benefits both parties when issues arise.

Denial Management and Appeals Excellence

Systematic denial analysis and root cause identification focus on eliminating denial sources rather than just working on individual cases. Healthcare RCM requires analyzing denial patterns by reason, payer, provider, and service type to identify improvement opportunities.

Appeal preparation strategies and persuasive documentation techniques ensure appeals are complete and compelling. Different payers have different appeal processes and requirements, so preparation must be thorough and payer-specific.

Timeline management and deadline tracking across multiple payers prevent appeals from being dismissed due to late filing. Missing appeal deadlines converts potentially collectible claims into permanent write-offs.

Prevention-focused approaches based on denial pattern analysis address root causes through process improvements, additional training, or system enhancements. RCM revenue cycle management should focus on prevention rather than just appeals management.

When the Canvas Gets Messy: Solving Common Claims Management Challenges

Even practices with good intentions encounter obstacles that undermine revenue cycle optimization. Understanding these challenges helps you avoid costly mistakes that delay payments and increase administrative burden.

Documentation and Coding Obstacles

Incomplete clinical documentation issues remain the leading cause of medical necessity denials. Provider training solutions must emphasize the connection between clinical documentation and practice revenue. RCM cycle in medical billing success requires comprehensive documentation that supports every service billed.

Common coding errors include using outdated codes, missing required modifiers, and failing to understand bundling rules. Systematic prevention strategies include regular training, advanced editing software, and systematic quality reviews.

Medical necessity challenges occur when clinical notes don’t clearly establish the relationship between patient symptoms, diagnoses, and treatments. Documentation improvement protocols should include templates, guidelines, and regular feedback to providers.

Compliance issues require ongoing education and systematic monitoring of regulatory changes. Revenue cycle management in medical billing must adapt to evolving requirements while maintaining operational efficiency.

Process and Technology Integration Problems

Workflow bottlenecks create delays that impact entire revenue cycles. Systematic process optimization should identify and eliminate these bottlenecks through better workflows, additional resources, or technology solutions.

Technology integration challenges occur when different systems don’t communicate effectively. RCM systems should provide comprehensive integration capabilities that eliminate data silos and manual data entry.

Staff training gaps create knowledge deficiencies that lead to errors and inefficiencies. Comprehensive education programs should address both technical skills and understanding of how individual roles contribute to overall success.

Quality control inadequacies allow errors to reach payers, creating expensive rework and delays. Quality control should be built into workflows rather than treated as occasional audit activities.

Timing and Compliance Complexities

Timely filing deadline management requires systematic tracking across multiple payers. Each payer has different filing deadlines, and missing these deadlines converts collectible claims into permanent write-offs.

Authorization lapses can invalidate coverage for services already provided. Proactive renewal strategies should include systematic tracking of authorization dates and automated alerts before expiration.

Appeal deadline tracking requires systematic management because appeals typically have much shorter deadlines than original filing requirements. Missing appeal deadlines eliminates any opportunity to collect on denied claims.

Regulatory compliance monitoring and adaptation strategies help practices stay current with changing requirements. Healthcare revenue cycle management must include systematic monitoring of regulatory updates and implementation of necessary changes.

When the Canvas Gets Messy: Solving Common Claims Management Challenges

Even practices with good intentions encounter obstacles that undermine revenue cycle optimization. Understanding these challenges helps you avoid costly mistakes that delay payments and increase administrative burden.

Documentation and Coding Obstacles

Incomplete clinical documentation issues remain the leading cause of medical necessity denials. Provider training solutions must emphasize the connection between clinical documentation and practice revenue. RCM cycle in medical billing success requires comprehensive documentation that supports every service billed.

Common coding errors include using outdated codes, missing required modifiers, and failing to understand bundling rules. Systematic prevention strategies include regular training, advanced editing software, and systematic quality reviews.

Medical necessity challenges occur when clinical notes don’t clearly establish the relationship between patient symptoms, diagnoses, and treatments. Documentation improvement protocols should include templates, guidelines, and regular feedback to providers.

Compliance issues require ongoing education and systematic monitoring of regulatory changes. Revenue cycle management in medical billing must adapt to evolving requirements while maintaining operational efficiency.

Process and Technology Integration Problems

Workflow bottlenecks create delays that impact entire revenue cycles. Systematic process optimization should identify and eliminate these bottlenecks through better workflows, additional resources, or technology solutions.

Technology integration challenges occur when different systems don’t communicate effectively. RCM systems should provide comprehensive integration capabilities that eliminate data silos and manual data entry.

Staff training gaps create knowledge deficiencies that lead to errors and inefficiencies. Comprehensive education programs should address both technical skills and understanding of how individual roles contribute to overall success.

Quality control inadequacies allow errors to reach payers, creating expensive rework and delays. Quality control should be built into workflows rather than treated as occasional audit activities.

Timing and Compliance Complexities

Timely filing deadline management requires systematic tracking across multiple payers. Each payer has different filing deadlines, and missing these deadlines converts collectible claims into permanent write-offs.

Authorization lapses can invalidate coverage for services already provided. Proactive renewal strategies should include systematic tracking of authorization dates and automated alerts before expiration.

Appeal deadline tracking requires systematic management because appeals typically have much shorter deadlines than original filing requirements. Missing appeal deadlines eliminates any opportunity to collect on denied claims.

Regulatory compliance monitoring and adaptation strategies help practices stay current with changing requirements. Healthcare revenue cycle management must include systematic monitoring of regulatory updates and implementation of necessary changes.

Advanced Brushes and Palette: Technology That Elevates Claims Performance

Modern technology transforms claims management from manual, error-prone processes into automated, efficient systems that accelerate payments and reduce administrative burden. Revenue cycle management technology provides capabilities that were impossible just a few years ago.

Modern Claims Management Platforms

Comprehensive practice management system integration connects every aspect of the revenue cycle process from patient scheduling through final payment. Integrated systems eliminate duplicate data entry, reduce errors, and provide real-time visibility into claim status and financial performance.

Advanced claim scrubbing and validation capabilities check claims against thousands of rules and requirements before submission. These systems catch errors that manual review might miss while processing claims much faster than human reviewers.

Automated workflow tools and process optimization features eliminate manual steps while ensuring consistent execution. RCM medical billing systems can route claims through approval processes, apply final edits, and submit claims without manual intervention.

Real-time analytics and performance monitoring dashboards provide insights that guide decision-making and identify improvement opportunities. Modern revenue cycle management systems can generate reports on demand and provide dashboard views of key performance indicators.

Emerging Technologies and AI Applications

Predictive analytics for denial prevention identifies patterns that help prevent problems before they occur. Machine learning algorithms analyze historical data to predict which claims are likely to be denied and suggest preventive actions.

Automated coding assistance and accuracy improvement tools analyze clinical documentation and suggest appropriate codes. These tools improve coding accuracy while reducing the time required for manual code selection.

Machine learning applications for continuous process optimization learn from patterns and outcomes to suggest improvements. RCM management systems using artificial intelligence continuously improve their accuracy and effectiveness.

Robotic process automation for routine task management handles activities like eligibility verification, claim scrubbing, and payment posting. This automation frees staff to focus on more complex activities that require human judgment.

Future-Proofing Your Claims Process

Scalable technology solutions accommodate growing practices without requiring system replacements. Healthcare RCM systems should grow with practices and adapt to changing needs without major disruptions.

Integration capabilities for evolving healthcare ecosystems ensure that technology investments remain valuable as the industry changes. Systems should provide APIs and integration tools that support future connectivity needs.

Adaptation strategies for changing industry requirements help practices stay ahead of regulatory and payer changes. Technology platforms should be flexible enough to accommodate new requirements without complete system overhauls.

Investment planning for sustainable technology advancement balances current needs with future requirements. Practices should choose systems that provide upgrade paths and ongoing development rather than static solutions.

Creating Your Revenue Masterpiece

The art of claims submission and follow-up combines technical precision, strategic thinking, and systematic execution to create predictable revenue streams and optimal cash flow. Mastery requires attention to detail, consistent practice, continuous learning, and adaptation to changing industry landscapes.

Practices that master these artistic elements typically achieve clean claim rates above 95%, denial rates below 5%, and payment cycles under 30 days. These performance levels translate directly to improved profitability, reduced administrative burden, and enhanced cash flow predictability.

The benefits of revenue cycle management optimization are substantial and measurable. Practices implementing comprehensive healthcare revenue cycle management strategies see 30-50% reductions in days in accounts receivable, 60-80% reductions in denial rates, and 15-25% improvements in collection rates.

These improvements free up staff time and resources that can be redirected to patient care and practice growth. More importantly, they create the financial stability that allows practices to focus on their primary mission of providing excellent healthcare.

Revenue cycle optimization isn’t a one-time project but an ongoing process of refinement and improvement. The healthcare industry continues to evolve, and successful practices adapt their processes while maintaining the artistic principles that drive consistent results.

Ready to transform your claims process from amateur sketches to masterpiece collections? Contact The Heaven Solutions today for a comprehensive claims management assessment. Our proven artistic methodologies have helped hundreds of practices perfect their claims submission and follow-up processes, achieving clean claim rates above 95% while reducing payment cycles by 40%.

Don’t let imperfect techniques cost you another dollar in delayed payments – start creating your revenue masterpiece today. Remember, in the art of healthcare revenue management, every claim is a brushstroke in your practice’s financial success story. Make each one count.