RCM

How to Perfect Your Claims Submission Process and Follow Up

What’s Included

Featured Post

The Top Denial Reasons by Insurance Payers and How to Boldly Outsmart Them

Every healthcare practice submits thousands of claims annually, but the difference between getting paid in 14 days versus 60+ days often comes down to perfecting two critical skills: submission accuracy and systematic follow-up. The gap between high-performing and struggling practices isn’t about patient volume or complexity; it’s about mastering the fundamentals of RCM in medical billing.

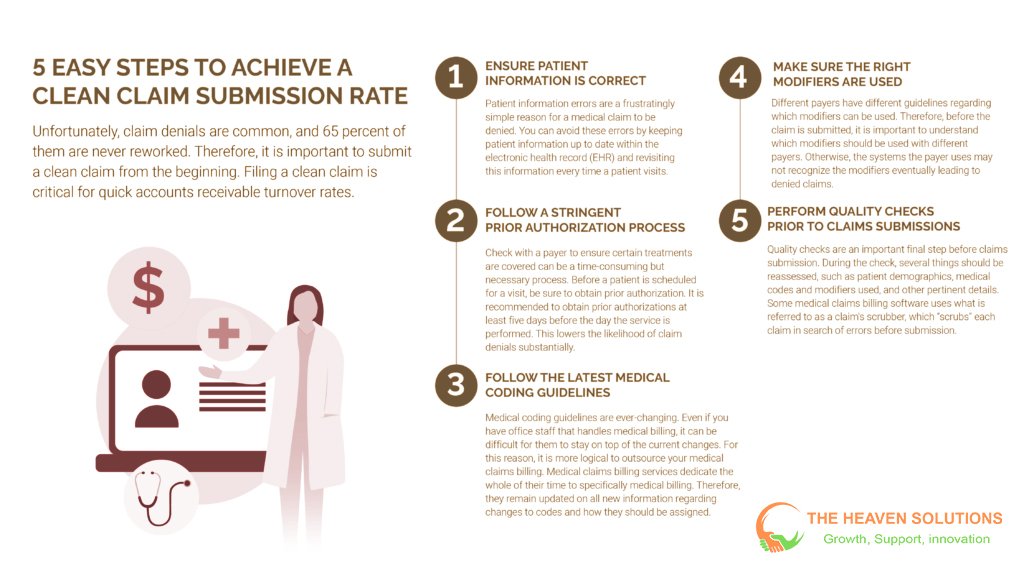

Current challenges in healthcare revenue cycle management are mounting. Industry denial rates average 5-10%, with some practices experiencing rates as high as 20%. Each denied claim costs $25-$40 in administrative expenses to research, correct, and resubmit. For a practice submitting 1,000 claims monthly, even a 10% denial rate means $2,500-$4,000 in additional costs before considering delayed cash flow impacts.

A perfected claims submission process combined with strategic follow-up protocols can reduce denial rates to below 3% while accelerating payment cycles by 40-50%. This comprehensive guide walks you through the essential elements of clean claims, proven submission workflows, systematic follow-up strategies, and continuous improvement methodologies that transform medical billing RCM from reactive to proactive.

Your First Line of Defense Against Payment Delays

Clean claims represent the cornerstone of efficient revenue cycle management and directly determine your practice’s cash flow predictability. Understanding what RCM is starts with recognizing that every dollar collected begins with a perfectly prepared claim.

The statistics paint a clear picture. Clean claims get processed in 14-21 days, while problematic claims can take 45-90 days or longer to resolve. Each claim requiring rework costs $25-$40 in additional administrative expenses. Top-performing practices achieve clean claim rates above 95%, compared to industry averages of 75-85% for typical practices.

Clean claim rates directly correlate with practice profitability, staff efficiency, and patient satisfaction. When claims are submitted correctly the first time, administrative staff spend less time on rework and follow-up activities. Patients receive fewer confusing billing statements and collection calls. Cash flow becomes predictable, allowing practice owners to plan for growth and investment.

The benefits of revenue cycle management become immediately apparent when clean claim rates improve. A practice generating $2 million annually in charges can see additional collections of $100,000-$200,000 by improving clean claim rates from 80% to 95%, while reducing administrative costs by 20-30%.

What defines a clean claim in healthcare RCM? It contains complete, accurate patient demographics exactly matching insurance records. Insurance information is current and verified in real-time. Clinical documentation supports medical necessity for all services billed. Coding is accurate with appropriate ICD-10 diagnostic codes and CPT procedure codes, including required modifiers. All payer-specific requirements are met.

Pre-Submission Strategies That Prevent Denials

Understanding what RCM means in healthcare requires recognizing that success happens before claims are submitted. Pre-submission processes eliminate 80% of common denial reasons while reducing administrative burden for your entire team.

Patient Information and Eligibility Verification

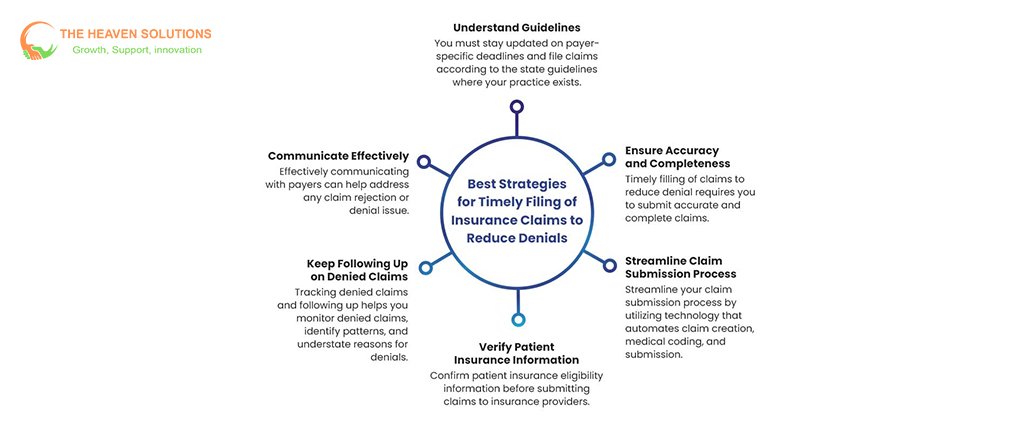

Real-time eligibility verification at multiple touchpoints catches coverage changes before they become expensive problems. Modern RCM systems check eligibility when appointments are scheduled, during patient check-in, and immediately before services are provided. This three-point verification prevents the most common category of claim denials, eligibility and coverage issues.

Demographic data accuracy protocols ensure that patient names, addresses, dates of birth, and insurance ID numbers match exactly what’s on file with insurance companies. Simple typos in any of these fields trigger immediate claim rejections. Systematic verification procedures include asking patients to confirm their information at each visit and requiring current insurance cards.

Insurance benefit confirmation goes beyond simple eligibility to understand deductibles, copayments, coinsurance percentages, and coverage limitations. RCM medical billing requires comprehensive benefit verification to ensure accurate patient financial responsibility calculation and proper claim submission.

Prior authorization management workflows track authorization requirements across different payers and service types. Healthcare revenue cycle management systems must monitor authorization status, expiration dates, and renewal requirements to prevent coverage denials after services are provided.

Clinical Documentation and Coding Accuracy

Medical necessity documentation requirements must be understood and followed by clinical staff. Every service billed must be supported by clinical documentation that clearly explains why the service was necessary for the patient’s condition. Revenue cycle management in healthcare success depends on providers’ understanding of how their documentation affects billing and collections.

ICD-10 and CPT coding accuracy protocols include systematic review processes that catch errors before claims are submitted. Whether coding is done internally or outsourced, quality control processes must verify code selection, modifier usage, and compliance with bundling rules. RCM revenue cycle management requires ongoing education as codes and rules change annually.

Integration between clinical and billing systems eliminates duplicate data entry while ensuring accurate data flow. Medical revenue cycle management systems must connect electronic health records with practice management systems to streamline workflows and reduce errors.

Quality assurance checkpoints built into daily workflows catch documentation and coding errors before they reach payers. These systematic reviews should be conducted by qualified professionals who understand both clinical requirements and coding compliance issues.

Technology-Enabled Quality Control

Automated claim scrubbing software provides real-time validation against thousands of coding rules and payer requirements. RCM systems with advanced editing capabilities check claims for missing information, invalid code combinations, medical necessity issues, and payer-specific requirements before submission.

Edit checks and validation rules prevent common errors like missing modifiers, incorrect date ranges, and invalid provider-procedure combinations. These automated systems catch errors that manual review might miss while processing claims much faster than human reviewers.

Payer-specific requirement databases ensure claims meet unique submission requirements for different insurance companies. Revenue cycle management systems must maintain current databases of payer rules and update them regularly as requirements change.

Integration with practice management systems creates seamless workflows from patient scheduling through final payment. Healthcare RCM optimization requires comprehensive integration that eliminates data silos and manual data entry.

Submission Mastery: Getting It Right Every Time

Perfect submission requires understanding technical requirements, timing considerations, and payer relationships that determine processing success. What is revenue cycle management in healthcare becomes clear when you see how systematic submission processes accelerate payments and reduce administrative burden.

Electronic Submission Best Practices

EDI standards and electronic claim formatting requirements ensure that claims are processed quickly and accurately. Electronic Data Interchange (EDI) transactions use standardized formats that payers can process automatically. RCM billing systems must support standard transaction types, including 837P (professional claims), 837I (institutional claims), and various inquiry and response transactions.

Batch processing allows practices to submit multiple claims simultaneously while maintaining quality control. Daily batch submission provides optimal cash flow timing, while weekly submission may be more manageable for smaller practices. Revenue cycle process optimization requires balancing submission frequency with administrative efficiency.

Payer portal management involves maintaining access credentials, understanding portal-specific requirements, and managing different submission processes for different payers. Some payers require portal submission for certain claim types or prior authorizations, adding complexity to medical billing revenue cycle processes.

Timing strategies for optimal processing consider payer processing schedules, weekend and holiday impacts, and cash flow needs. Healthcare revenue cycle management systems can automate submission schedules to ensure consistent, timely filing while maximizing processing speed.

Quality Assurance and Final Checks

Final validation protocols before submission include comprehensive reviews of patient demographics, insurance information, coding accuracy, and documentation completeness. RCM management requires systematic quality control that catches errors at the last possible moment before submission.

Systematic review processes and approval workflows ensure that claims meet all requirements before leaving your practice. These processes should include multiple checkpoints for high-value claims and systematic sampling for routine claims.

Staff training and responsibility assignment ensure consistent submission processes regardless of staff schedules or availability. Clear protocols and backup procedures prevent submission delays when key staff members are unavailable.

Documentation requirements for audit trails track every claim from preparation through final payment. Revenue cycle management in medical billing requires comprehensive documentation that supports compliance reviews and performance analysis.

Submission Tracking and Monitoring

Real-time submission confirmation and acknowledgment tracking provide immediate feedback on submission success. RCM systems should generate confirmation reports that verify claims were received and accepted by payers or clearinghouses.

Initial processing status monitoring and early warning systems identify claims that encounter immediate processing problems. Electronic acknowledgments typically arrive within 24-48 hours and indicate whether claims were accepted or rejected for processing.

Performance metrics tracking includes monitoring clean claim rates, submission volumes, and processing success rates. Healthcare revenue management requires ongoing measurement to identify trends and improvement opportunities.

Integration with follow-up workflows creates seamless transitions from submission to tracking and follow-up activities. Revenue cycle optimization requires automated workflows that move claims through different processing stages without manual intervention.

Turning Submitted Claims into Collected Revenue

Strategic follow-up transforms submitted claims into collected revenue through systematic tracking and professional payer communication. RCM in healthcare includes understanding that submission is just the beginning: follow-up determines whether claims get paid promptly or age indefinitely.

Systematic Tracking and Monitoring

Aging reports and claim status monitoring systems provide visibility into claim processing progress and identify claims requiring immediate attention. RCM systems should generate daily aging reports that categorize claims by age, payer, and dollar amount to guide follow-up priorities.

Priority classification based on claim value, age, and payer type optimizes staff time and effort. High-dollar claims may require follow-up within 7-14 days, while routine claims might be followed up at 21-30-day intervals. Medical revenue cycle management requires strategic resource allocation to maximize collection results.

Automated alerts and escalation protocols ensure that no claims fall through tracking gaps. Healthcare RCM systems should automatically generate follow-up lists and alerts when claims reach predetermined age thresholds.

Performance dashboards provide real-time visibility into key metrics, including days in accounts receivable, denial rates, and collection performance. Revenue cycle management in healthcare requires data-driven decision-making supported by comprehensive reporting tools.

Effective Payer Communication Strategies

Phone follow-up best practices include preparing for calls with complete claim information, understanding payer-specific procedures, and maintaining professional communication throughout all interactions. Effective scripts help staff gather needed information efficiently while building positive payer relationships.

Electronic inquiry systems using 270/271 transactions provide automated claim status checking that’s faster and more accurate than phone calls. RCM revenue cycle management systems can submit these inquiries automatically and process responses to update claim status in real-time.

Written correspondence protocols ensure that written inquiries and appeals are professional, complete, and persuasive. Templates and standard procedures help maintain consistency while allowing customization for specific situations.

Relationship management with payer representatives builds partnerships that facilitate problem resolution and provide advance notice of policy changes. Regular communication with payer contacts helps practices stay current with changing requirements and resolve issues quickly.

Denial Management and Appeals Excellence

Systematic denial analysis and root cause identification focus on eliminating the sources of denials rather than just working on individual cases. Healthcare revenue cycle management requires analyzing denial patterns by reason, payer, provider, and service type to identify improvement opportunities.

Appeal preparation and submission procedures with timeline management ensure appeals are complete, persuasive, and submitted within required timeframes. Different payers have different appeal processes and deadlines, requiring systematic tracking and management.

Documentation requirements for successful appeals include comprehensive medical records, clear explanations of medical necessity, and professional presentation. Revenue cycle management success depends on thorough preparation and attention to detail.

Prevention strategies based on denial pattern analysis address root causes through process improvements, additional training, or system enhancements. RCM services should focus on prevention rather than just appeals management.

Critical Mistakes That Sabotage Claims Success

Even practices with good intentions can fall into common traps that undermine revenue cycle management success. Understanding these pitfalls helps you avoid costly mistakes that delay payments and increase administrative burden.

Documentation and Coding Pitfalls

Incomplete clinical documentation leading to medical necessity denials remains the most common and expensive category of preventable claim problems. Providers must document not just what they did, but why it was necessary for the patient’s condition. RCM cycle in medical billing success requires comprehensive clinical documentation that supports every service billed.

Common coding errors include using outdated codes, missing required modifiers, and failing to understand bundling rules. Regular training on coding updates and compliance requirements prevents these costly mistakes. Medical billing RCM requires ongoing education as codes and rules change frequently.

Medical necessity gaps occur when clinical notes don’t clearly establish the relationship between patient symptoms, diagnoses, and treatments provided. Every service must be justified by clinical necessity, which is clearly documented in the medical record.

Modifier misuse and bundling problems result in claim denials, reduced payments, or compliance issues. Understanding when modifiers are required and how bundling rules apply requires specialized knowledge and ongoing attention to payer policies.

Process and Workflow Failures

Inconsistent follow-up procedures allow claims to age unnecessarily and may result in missed filing deadlines. Healthcare revenue cycle management requires systematic processes with clear responsibilities and timelines to ensure consistent execution.

Technology integration problems create data silos, duplicate work, and opportunities for errors. Comprehensive integration between clinical and billing systems is essential for efficient RCM management.

Staff training gaps and communication breakdowns create knowledge deficiencies that lead to errors and inefficiencies. Revenue cycle management in healthcare requires ongoing education as regulations, codes, and payer policies change constantly.

Quality control inadequacies allow errors to reach payers, creating expensive rework and delays. Quality control should be built into workflows rather than treated as occasional audit activities.

Timing and Compliance Oversights

Timely filing deadline management across multiple payers requires systematic tracking and monitoring. Each payer has different filing deadlines, and missing these deadlines converts collectible claims into permanent write-offs.

Authorization lapses and renewal failures can invalidate coverage for services already provided. RCM systems should track authorization dates and alert staff before authorizations expire.

Appeal deadline mismanagement is particularly costly because appeals typically have much shorter deadlines than original filing requirements. Missing appeal deadlines eliminates any opportunity to collect on denied claims.

Regulatory compliance oversights can result in audits, penalties, and claim rejections. Staying current with changing regulations requires dedicated resources and systematic monitoring of updates.

Never Stop Improving: Building a Culture of Claims Excellence

Continuous improvement ensures long-term success in healthcare revenue cycle management by adapting to changing industry requirements while maintaining operational excellence. The most successful practices never stop refining their processes.

Performance Measurement and Analytics

Key performance indicator (KPI) tracking provides objective measures of improvement and identifies areas needing attention. Important metrics include clean claim rate (target: 95%+), denial rate (target: <5%), days in accounts receivable (target: <40 days), and net collection rate (target: >95%).

Trend analysis and predictive analytics identify patterns and opportunities that human analysis might miss. RCM systems using advanced analytics can predict which claims are likely to be denied and suggest preventive actions.

Staff performance monitoring and individual coaching opportunities help team members improve their skills while contributing to overall practice success. Regular feedback and professional development create engaged, competent staff.

Financial impact measurement and ROI calculations demonstrate the value of revenue cycle optimization investments. Practices should track improvements in collection rates, reduction in administrative costs, and acceleration of cash flow.

Technology Advancement and Innovation

Emerging technologies, including artificial intelligence and machine learning, transform claims management from reactive to predictive. RCM management systems with AI capabilities can identify denial risks before submission and suggest corrections.

System integration improvements and workflow optimization eliminate manual processes while improving accuracy and consistency. Cloud-based revenue cycle management systems provide advanced capabilities at costs accessible to smaller practices.

Automation opportunities for routine tasks, including eligibility verification, claim scrubbing, and payment posting, free staff to focus on more complex activities requiring human judgment and expertise.

Future-proofing strategies for evolving industry requirements ensure that technology investments remain valuable as healthcare continues to change. Healthcare RCM systems should be flexible enough to adapt to new requirements and integrate with emerging technologies.

Staff Development and Training Programs

Ongoing education programs for coding updates and payer changes keep staff current with evolving requirements. Revenue cycle management in medical billing requires continuous learning as regulations and payer policies change frequently.

Cross-training strategies create operational resilience by ensuring multiple staff members can handle critical functions. This approach prevents disruptions when key employees are unavailable.

Performance feedback systems and professional development create motivated, capable teams that take pride in their contributions to practice success. Recognition and advancement opportunities retain valuable employees while attracting quality candidates.

Building internal expertise versus outsourcing considerations depend on practice size, complexity, and strategic priorities. Some practices benefit from developing internal capabilities, while others achieve better results through strategic partnerships with RCM services providers.

Transform Your Claims Process Into a Revenue Engine

Perfect claims submission and follow-up require systematic approaches encompassing clean claim preparation, strategic submission processes, effective follow-up protocols, mistake prevention, and continuous improvement. Practices that perfect these elements achieve denial rates below 3%, payment cycles under 30 days, and collection rates above 97%.

The key insights for revenue cycle optimization are clear:

Clean claims are non-negotiable for financial success. Every process improvement should focus on increasing the percentage of claims that are processed and paid without additional work.

Systematic processes outperform ad-hoc approaches every time. Consistency in execution creates predictable results and sustainable improvements.

Technology enables excellence but doesn’t replace good fundamentals. The most advanced RCM systems cannot overcome poor processes or inadequate training.

Continuous improvement is essential for sustained success. The healthcare industry continues to evolve, and successful practices adapt their processes while maintaining operational excellence.

The financial benefits are substantial. Practices implementing comprehensive healthcare revenue cycle management strategies typically see 30-50% reductions in days in accounts receivable, 60-80% reductions in denial rates, and 15-25% improvements in collection rates.

These improvements translate directly to improved cash flow, reduced administrative costs, and enhanced profitability. More importantly, they free up staff time and resources that can be redirected to patient care and practice growth initiatives.

Ready to perfect your claims submission process and accelerate your revenue cycle? Contact The Heaven Solutions today for a comprehensive claims management assessment. Our proven methodologies have helped hundreds of practices achieve clean claim rates above 95% while reducing payment cycles by 40%.

Don’t let imperfect processes cost you another dollar in delayed payments. Start your transformation today. In healthcare, perfect claims submission isn’t just about getting paid faste,r it’s about building the financial foundation that allows you to focus on what matters most: exceptional patient care.