RCM

Essential Denial Management 101 The Step-by-Step Success Blueprint for Providers

What’s Included

Featured Post

The Top Denial Reasons by Insurance Payers and How to Boldly Outsmart Them

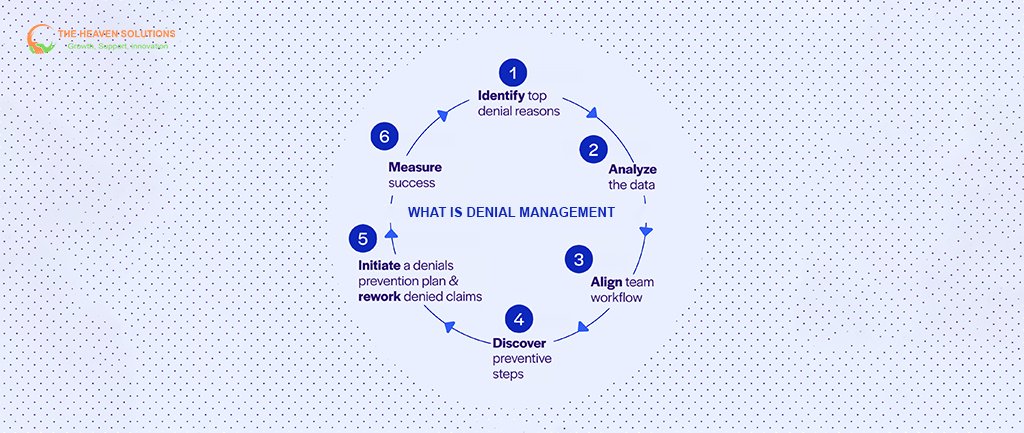

If you work in healthcare billing, you know claim denials are a constant; industry averages put denial rates between 10% and 15%. Learning to manage them isn’t just helpful, it’s necessary for your practice’s financial health. Many healthcare professionals are all too familiar with frustrating rejection codes and the stress of watching lost revenue pile up. The upside? Denial management can be learned, improved, and built into your workflow to protect your revenue and reduce headaches across your team.

Let’s walk through the essentials of denial management. You’ll find out what typically causes denials, how to prevent them, and see practical steps for turning more denials into payments, all while weaving effective denial management into your broader revenue cycle management (RCM) process.

Denial management is about more than fixing problems after they pop up. In healthcare, it means actively identifying, tracking, and resolving rejected claims with the goal of keeping your revenue cycle moving forward.

Think of denial management as your safeguard against unnecessary financial losses, and as a way to recover revenue where you still have the chance. It’s a key part of every RCM system, but denial management specifically focuses on the points where workflows break down.

So, what does RCM mean in healthcare? Revenue cycle management is every step from scheduling to final payment, closely tracking each dollar. A denied claim creates a gap in this cycle and impacts cash flow sometimes for months at a time.

Denial management only works if everyone, billers, clinicians, managers, and leadership, knows their part. Collaboration is just as important as having good software or processes.

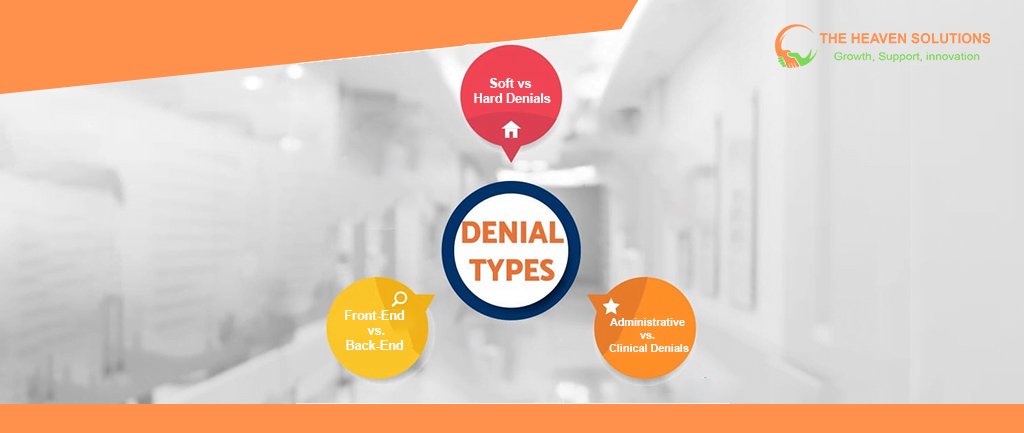

Know Your Enemy: The Different Types of Denials You'll Face

Every denial is not created equal. Knowing the type you’re up against helps you respond effectively:

Soft vs. Hard Denials

Soft denials are temporary. You can usually fix the issue and resubmit, often by clarifying a code or adding documentation.

Hard denials are permanent, typically resulting from policy exclusions, missed deadlines, or services deemed not covered. These rarely get paid, even after appeal.

Front-End vs. Back-End Denials

Front-end denials happen before your claim even reaches the insurance company. Think of a claim rejected by your billing system or clearinghouse for missing fields.

Back-end denials come after the payer reviews your claim and finds an issue, sometimes related to medical necessity or coverage policy.

Administrative vs. Clinical Denials

Administrative denials involve data errors, missing paperwork, or eligibility issues and are typically easier to fix.

Clinical denials relate to the necessity or appropriateness of care, demanding solid documentation and clinical input, sometimes even peer-to-peer reviews.

Understanding these types keeps your response quick and focused.

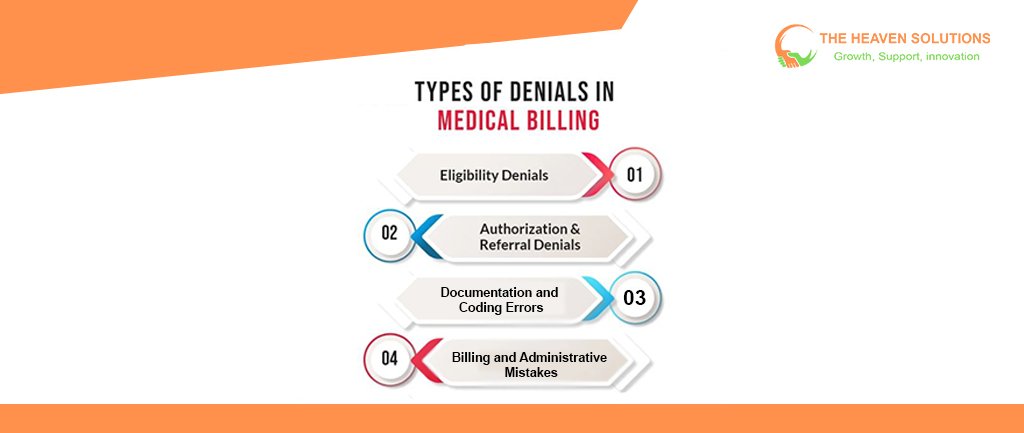

The Usual Suspects: Top Causes of Healthcare Claim Denials

Most denials come from a handful of recurring issues. Spotting these gives you real levers to control future denials:

Patient Eligibility and Coverage Issues

Expired or inactive insurance, missing subscriber info, and coverage limitations can all trigger denials. It’s essential to verify insurance and update information regularly.

Authorization and Referral Problems

Missing prior authorizations or out-of-date referrals are common obstacles, especially for specialty or surgical procedures that insurers scrutinize. Always check what’s required, sometimes even on routine visits.

Documentation and Coding Errors

A missed chart note, unclear procedure, or wrong code can spell immediate rejection. Bundling, unbundling, or using non-specific codes are also common reasons. Clean, clear, and comprehensive clinical documentation supports both initial billing and any appeals.

Billing and Administrative Mistakes

From duplicate claims to missing signatures or late filings, simple errors cost real money. Many of these are preventable with consistent workflow checks and steady staff training.

Counting the Cost: How Denials Affect Your Bottom Line

Every denied claim erodes your revenue. Leaving them unaddressed puts more than just one payment at risk:

- Direct Loss: If you process 10,000 claims a year with a 12% denial rate, and only address half, lost payments could be $50,000–$100,000 or more.

- Admin Strain: The longer a denial sits, the harder it is to resolve. An issue that could be fixed in 20 minutes may take hours or be written off if left.

- Cash Flow Disruption: Unresolved claims delay the income you count on for payroll, supplies, or growth.

- Lost Opportunities: Money stuck in limbo can’t be used for improvements, team incentives, or better tech.

- Practice Morale: A culture that tolerates write-offs leads to complacency and missed chances for improvement.

Bottom line: Even one ignored denial can cost more than you think over time.

Setting Up for Success: Creating a Systematic Approach

To reduce denials and recover lost revenue, you need a thorough, team-driven approach:

Prevention

- Start with strong patient registration and eligibility verification.

- Build prior authorization checks into scheduling.

- Standardize documentation with prompts/templates to capture everything needed for billing and appeals.

- Train your team frequently, as insurance policies, codes, and requirements evolve constantly.

Early Detection

- Use RCM systems for real-time claim monitoring to catch issues before submission.

- Set alerts for authorization, referral status, and unpaid claims.

- Review monthly denial reports, watch for patterns and systemic issues.

Effective Workflows

- Triage denials: Prioritize by dollar value and appeal deadlines.

- Assign the right staff, from administrative fixes to clinical justification.

- Use prepared templates and checklists for appeals.

- Never let denied claims vanish; track each one through to resolution.

From Denial to Payment: A Step-by-Step Resolution Guide

A clear process turns more denials into payments:

- Review the denial reason and code. Understand exactly why the claim was rejected.

- Compile supporting documentation. The sooner, the better. Late documentation is harder to source.

- Weigh the recovery value. Focus your energy on larger or repeatable issues; small denials can sometimes be less cost-effective to pursue.

- Draft and submit your appeal. Use focused, factual letters that directly address the reason for denial.

- Track appeal status. Follow up regularly, escalating to the right contact if needed.

Leveraging Technology: Tools That Make Denial Management Easier

Modern RCM technology can simplify denial management:

- Integrated EHR systems flag issues before they become denials.

- Denial management software automates tracking, assignment, and reporting.

- Analytics tools reveal denial trends so you can address repeat issues.

- Automation saves time and ensures consistency, letting staff focus on complex cases.

- Communication platforms allow all stakeholders to view status updates and next steps.

The right technology doesn’t replace people, but it empowers your team to do its best work.

Level Up Your Game: Advanced Denial Management Techniques

For providers ready to go further:

- Use predictive analytics to spot high-risk claims before they go out.

- Build payer profiles and tailor submissions to each insurer’s quirks.

- Track KPIs like denial rate, average resolution time, and appeal win percentages.

- Regularly update staff training with real-world denial examples from your own data.

- If you’re overwhelmed, consider denial management services for expert support without an in-house burden.

Tracking Your Progress: Key Metrics for Denial Management

Keep your efforts sharp by measuring results:

- What’s your initial denial rate? (Aim for less than 10%.)

- How often do your appeals succeed?

- How quickly are denials resolved?

- What does it cost you to recover a denied claim?

- Are recovery and resolution rates improving quarter over quarter?

Let your data guide regular improvements rather than relying on instinct or habit, and always use these insights to inform strategic decisions for your practice.

Building a Sustainable Denial Management Program

Making denial management routine keeps your team prepared and your revenue cycle healthier. Integrate these steps into your office culture:

- Train everyone regularly.

- Stick to the workflow even when things get busy.

- Invest in updating your technology when needed.

- Focus just as much on prevention as on appealing existing denials.

- Monitor results regularly and adapt when you see trends shift.

The goal: a system that improves as your team grows and as insurers change their rules.

Taking Action: Your Next Steps

Denial management isn’t about chasing every lost dollar; it’s about building a sustainable process so you recover what you’ve earned and prevent new denials from derailing your practice.

Start by assessing your current workflow. What’s your denial rate? Why are most denials happening? Do you have the tools and people you need to address them?

If large volumes or complex denials are overwhelming, don’t hesitate to reach out for specialized revenue cycle management support. Companies like The Heaven Solutions can help create or overhaul your process so you see more revenue, less admin hassle, and a healthier financial picture for your practice.

Remember: steady, systematic denial management means better cash flow, less wasted time, and a more confident team. Take the steps now so denials stop being a source of stress and start becoming opportunities for improvement in your revenue cycle