RCM

How Hidden Leaks Drain Your Practice's Revenue

What’s Included

- Claims Submission & Follow-Up

- Denial Management

- Accounts Receivable (AR) Recovery

- Payment Posting & Reconciliation

- Patient Statements & Collections

- Clearinghouse Setup & Integration

Featured Post

The Top Denial Reasons by Insurance Payers and How to Boldly Outsmart Them

How Hidden Leaks Drain Your Practice’s Revenue

What happens to a medical claim after it’s submitted? For many practices, it can feel like it enters a black hole of uncertainty. The common “wait and see” approach to the revenue cycle in healthcare is costing far more than you think. In a busy clinic, the focus is often on getting claims out the door quickly. The real work, however, happens in the days and weeks that follow. A lack of systematic follow-up on unpaid claims, denials, and patient balances is a primary source of revenue leakage in healthcare.

Delayed follow-ups are not just an administrative inconvenience; they are a significant financial drain. This oversight directly impacts your cash flow, increases operational costs, and ultimately hinders your practice’s ability to thrive. This post will uncover the hidden costs of delayed follow-ups, identify the most common areas where these delays occur, and provide actionable strategies to plug these revenue leaks for good.

The Direct Financial Impacts

The direct and measurable financial consequences of not acting quickly on outstanding accounts and unresolved claims can be severe. This is where a well-defined revenue cycle management process becomes critical. Procrastination in the RCM cycle leads to tangible losses that can destabilize a practice’s financial health.

The Devaluation of Aging Accounts Receivable (A/R)

There’s a fundamental principle in medical billing RCM: the older an insurance claim gets, the harder it becomes to collect. A claim that is 90 days old has a significantly lower chance of being paid in full than one that is only 30 days old. This aging A/R directly and negatively impacts your cash flow. When payments are delayed, your practice has less capital on hand to cover essential operating expenses like payroll, rent, and supplies. This is why effective RCM management focuses on keeping the A/R as current as possible.

Missing Timely Filing and Appeal Deadlines

Every insurance payer enforces strict deadlines. A common one is the timely filing limit for submitting a claim, but just as important is the deadline for appealing a denied claim. When a claim is denied, the clock starts ticking. A delayed follow-up can cause your practice to miss this narrow window for an appeal, turning a collectible claim into a permanent write-off. This is a clear example of billing loss that is almost always preventable. A robust healthcare revenue cycle management process includes protocols to ensure these deadlines are never missed.

Increased Cost to Collect

Delayed follow-ups are simply inefficient. An old, complex claim requires far more staff time, more phone calls with payers, and more administrative effort to resolve than a new one. As a claim ages, the details of the service become less fresh in everyone’s minds, and the paperwork can become harder to track down. This drives up the internal cost of collections, meaning you spend more money to recover the revenue you are already owed, which defeats the purpose of an efficient revenue cycle management system.

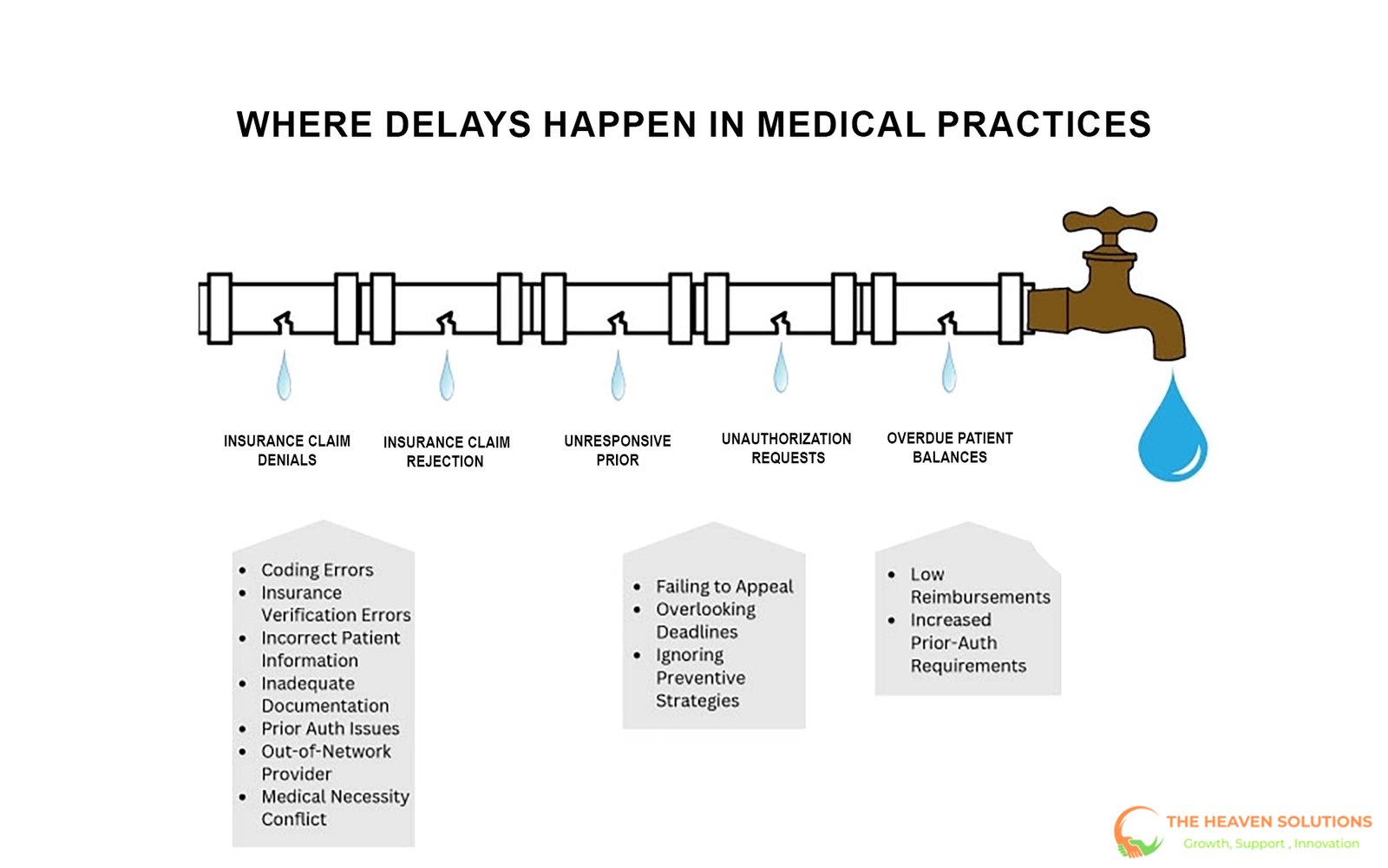

Where Delays Happen: Common Follow-Up Failures

To stop revenue leakage, you first need to identify where the leaks are coming from. These three critical areas are where follow-up failures most often occur, causing significant disruption to the medical billing revenue cycle.

1. Insurance Claim Denials and Rejections

This is the biggest and most damaging leak. When a claim is denied or rejected by a payer, it requires immediate investigation and action. The reason for the denial must be identified, the error must be corrected, and a formal appeal or corrected claim must be submitted. Delaying this process is the fastest way to lose that revenue. Without a dedicated person or team responsible for denial management, denied claims can quickly pile up, becoming part of the aging A/R that gets harder and harder to collect. This is a core component of the what is revenue cycle management in medical billing question; it’s about actively managing claims, not just submitting them.

2. Unresponsive Prior Authorization Requests

The second critical area is prior authorizations. A request for authorization is submitted for a procedure, but no one follows up to confirm it has been approved. This leads to rescheduled appointments, frustrated patients, and last-minute administrative scrambles. This failure to follow up creates bottlenecks in patient care and can even lead to a claim being denied after the fact if the service was performed without a confirmed authorization. Proactive follow-up ensures the patient revenue cycle starts smoothly.

3. Overdue Patient Balances

The final common failure is the lack of prompt follow-up with patients about their financial responsibilities. This includes co-pays, deductibles, and co-insurance. The longer a practice waits to send clear statements, make follow-up calls, or offer payment options, the less likely it is to collect what is owed. Just like with insurance claims, the probability of collecting from a patient decreases significantly over time. Effective RCM medical billing involves consistent and professional communication with patients about their balances.

Plugging the Leaks Strategies for Proactive Follow-Up

Transitioning from a reactive to a proactive mindset is the key to building an effective follow-up system. A strong revenue cycle management service is built on clear, repeatable processes that ensure nothing falls through the cracks. Here are practical strategies you can implement immediately.

Strategy 1: Systematize and Automate A/R Management

Stop treating A/R follow-up as a task to be done “when there’s time.” Use the reporting tools within your Practice Management (PM) system to systematize the work. For example, create a policy to run an A/R aging report every week. Then, establish a rule that every single claim over 30 days old must be touched, meaning it is reviewed and has a follow-up action documented. Many modern RCM systems can help automate this process by flagging accounts that need attention.

Strategy 2: Assign Clear Ownership and Accountability

Tasks that are everyone’s responsibility often become no one’s responsibility. Assign specific team members to be accountable for different follow-up functions. You could have one person manage commercial insurance A/R, another handle government payers, and a third oversee the prior authorization process. When a revenue cycle manager assigns clear ownership, it creates accountability and ensures that critical tasks are not forgotten in the daily rush.

Strategy 3: Develop a Denial Management Protocol

Create a clear, documented workflow for handling every denial. The moment a denial is received from a payer, it should be logged and categorized by reason (e.g., coding error, no authorization, non-covered service). From there, it should be assigned to the appropriate person or department for correction and appeal. This process should be tracked in your system until the denial is overturned and the claim is paid. This is a cornerstone of how to improve revenue cycle management.

Conclusion

Delayed follow-ups on claims, authorizations, and patient balances are not passive issues. They actively drain revenue from your practice, reduce your cash flow, and drive up your operational costs. A proactive, systematic follow-up strategy is not just a “nice-to-have”; it is essential for the financial health and long-term stability of any modern healthcare practice. It is a core component of effective revenue cycle management.

Stop letting hidden revenue leaks undermine all of your hard work. If your in-house team is too overwhelmed with patient care to manage consistent and aggressive follow-ups, it may be time to call in an expert.

Contact The Heaven Solutions today for a free consultation and learn how our dedicated A/R and denial management teams can help you secure every dollar you’ve earned.

Our core mission is to ensure you are paid fully and promptly for the services you provide. Through expert coding and aggressive denial management, we significantly increase your clean claim rate. This means more of your claims are approved on the first submission. Furthermore, our diligent A/R follow-up works to reduce days in accounts receivable. The result is a more predictable and robust cash flow.