RCM

Mastering Healthcare

Claims Submission and Follow-Up

The Ultimate Guide

What’s Included

- Clean Claims Your Gateway to Faster Healthcare Payments

- Before You Hit Send Pre-Submission Strategies That Prevent Rejections

- Submission Excellence Best Practices for First-Pass Success

- Follow-Up Like a Pro Systematic Approaches to Claim Tracking

- Dodge These Traps Common Claims Submission Mistakes & How to Avoid Them

- Your Blueprint for Claims Management Excellence

Featured Post

The Top Denial Reasons by Insurance Payers and How to Boldly Outsmart Them

The Top Denial Reasons by Insurance Payers and How to Boldly Outsmart Them

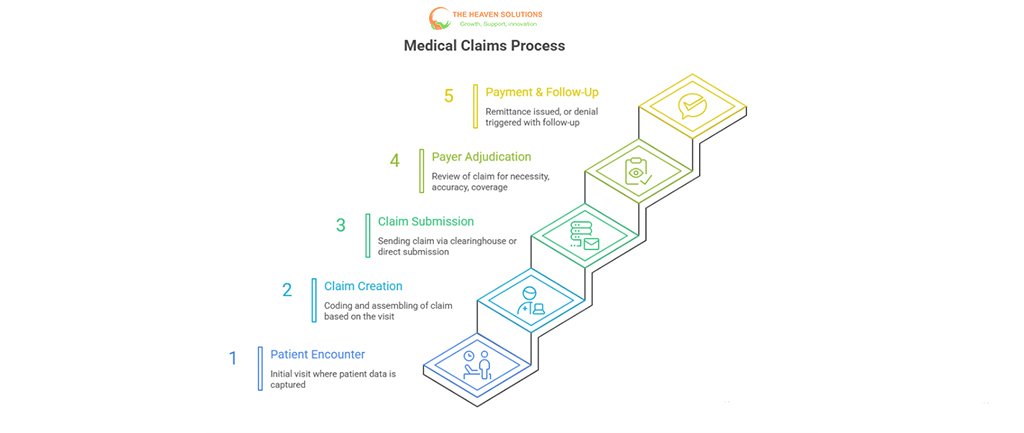

Healthcare practices face annual losses exceeding $262 billion due to inefficient claims management. Still, the difference between practices that get paid in 14 days versus 60+ days often comes down to how well they master claims submission and follow-up. The gap between high-performing and struggling practices isn’t about patient volume or services provided; it’s about the efficiency of their RCM in medical billing processes.

Strategic claims submission combined with systematic follow-up processes can reduce payment cycles by 50% while improving collection rates above 95%. When you understand what RCM is and implement proven methodologies, you transform your practice from a cash flow crisis to a predictable revenue machine.

This comprehensive guide covers everything you need to know about clean claims fundamentals, submission best practices, follow-up methodologies, technology solutions, and implementation strategies. By the end, you’ll have a complete roadmap for optimizing your revenue cycle management and accelerating your payments.

Understanding what RCM means in healthcare starts with recognizing that clean claims form the foundation of financial success. A clean claim contains complete, accurate information that allows payers to process payment without requesting additional information or denying the claim entirely.

What Makes a Claim "Clean"

Complete and accurate patient demographics serve as the starting point for clean claims. Every field must be populated correctly: patient name (exactly as it appears on the insurance card), date of birth, address, phone number, and social security number. A single typo in any of these fields can trigger an immediate rejection.

Correct insurance information and eligibility verification prevent the most common category of claim denials. Healthcare RCM systems must verify that insurance is active, benefits are available, and the patient hasn’t exceeded coverage limits. Real-time eligibility checking at multiple touchpoints when appointments are scheduled, during check-in, and before services are provided catches coverage changes before they become expensive problems.

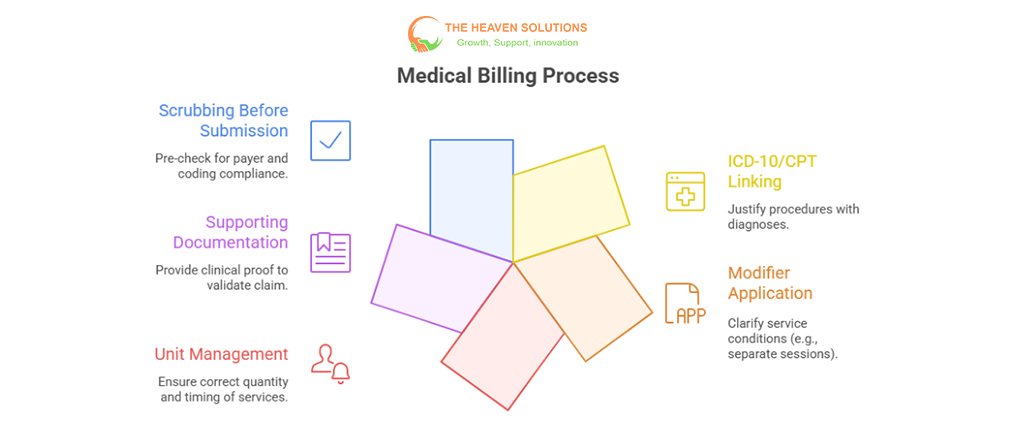

Proper coding with ICD-10 diagnostic codes and CPT procedure codes, including appropriate modifiers, ensures that claims accurately represent the services provided. RCM medical billing requires understanding complex coding relationships, bundling rules, and medical necessity requirements. Each code must be supported by clinical documentation that justifies the service provided.

Supporting documentation and medical necessity form the clinical foundation that supports coding and billing. Payers increasingly scrutinize claims to ensure services were appropriate and necessary for the patient’s condition. Without adequate documentation, even legitimate services may face medical necessity denials.

Compliance with payer-specific requirements adds another layer of complexity. Each insurance company has unique submission guidelines, preferred formats, and special requirements. RCM systems must accommodate these variations while maintaining consistency across different payers.

The Financial Impact of Clean vs. Dirty Claims

The financial difference between clean and dirty claims is dramatic. Clean claims typically get paid within 14-21 days of submission, while problematic claims can take 45-90 days or longer to resolve. This timing difference has massive cash flow implications for healthcare practices operating on thin margins.

Administrative costs compound the timing delays. Each claim that requires rework costs $25-$40 in additional administrative expenses. Staff must research the denial reason, contact patients or providers for additional information, correct the claim, and resubmit it. For a practice with a 15% denial rate, submitting 1,000 claims monthly, these costs add up to $3,750-$6,000 in additional monthly expenses.

Cash flow impact extends beyond direct costs. When claims are delayed by 30-60 days, practices must finance operations while waiting for payments. This financing cost, whether through bank loans, credit lines, or delayed vendor payment,s adds hidden expenses that erode profitability.

Industry Benchmarks and Performance Standards

High-performing practices achieve clean claim rates above 95%, meaning fewer than 5% of submitted claims require any follow-up or correction. These practices typically see denial rates below 5% and collect over 97% of their net collectible revenue.

Average practices struggle with clean claim rates between 75-85%, denial rates of 10-15%, and collection rates below 95%. The performance gap between high-performing and average practices represents tens of thousands of dollars annually for typical practices.

Revenue cycle optimization analysis shows that improving clean claim rates from 80% to 95% can increase annual collections by $50,000-$100,000 for a practice generating $2 million in annual charges, while reducing administrative costs by 25-30%.

Pre-Submission Strategies That Prevent Rejections

Success in medical billing RCM starts long before claims are submitted. Pre-submission processes determine whether claims will be paid quickly, delayed, or denied entirely. Practices that invest in comprehensive pre-submission strategies see immediate improvements in clean claim rates.

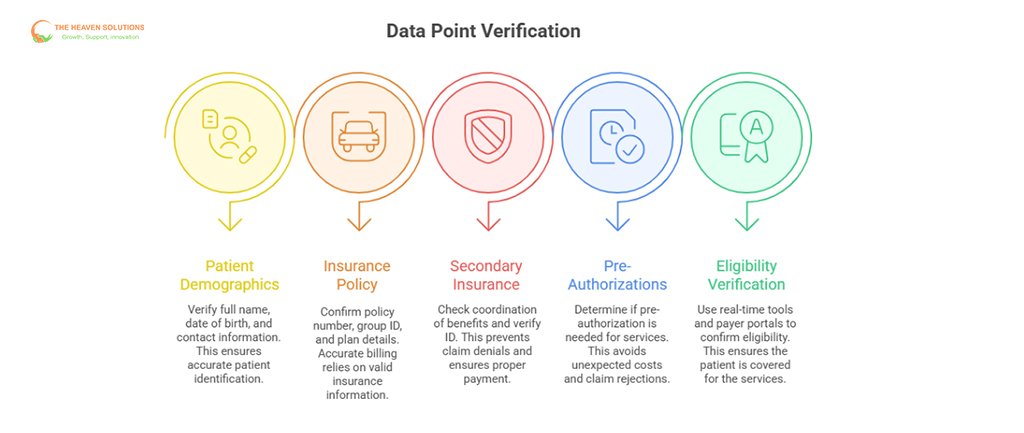

Patient Access and Verification Protocols

Real-time eligibility verification systems check insurance coverage at multiple patient touchpoints. Modern RCM billing systems can verify eligibility when appointments are scheduled, during patient check-in, and immediately before services are provided. This three-point verification catches coverage changes, policy cancellations, and benefit limitations before they cause claim denials.

Insurance benefit confirmation procedures go beyond simple eligibility checks to understand deductibles, copayments, coinsurance percentages, and out-of-network penalties. Patients need to understand their financial responsibility upfront, and practices need this information for accurate claim submission.

Prior authorization management workflows ensure that required approvals are obtained before services are provided. Healthcare RCM processes must track authorization requirements across different payers, manage approval timelines, and maintain documentation of all authorizations received.

Demographic data accuracy standards require systematic processes for collecting and verifying patient information. Simple procedures like asking patients to review their demographic information at each visit and requiring current insurance cards can prevent many claim rejections.

Clinical Documentation and Coding Excellence

Documentation requirements for medical necessity must be understood and followed by clinical staff. Every service billed must be supported by clinical documentation that clearly explains why the service was necessary for the patient’s condition. RCM management success depends on providers’ understanding of how their documentation affects billing and collections.

Coding accuracy protocols include systematic review processes that catch errors before claims are submitted. Whether coding is done internally or outsourced, quality control processes must verify code selection, modifier usage, and compliance with bundling rules.

Integration between clinical and billing systems eliminates duplicate data entry while ensuring that clinical information flows accurately to billing systems. Revenue cycle in healthcare optimization requires seamless data flow from encounter documentation through final claim submission.

Technology-Enabled Quality Control

Automated claim scrubbing software provides real-time validation against thousands of coding rules and payer requirements. These systems check claims for missing information, invalid code combinations, medical necessity issues, and payer-specific requirements before submission.

Edit checks and validation rules built into RCM systems prevent common errors like missing modifiers, incorrect date ranges, and invalid provider-procedure combinations. These automated checks catch errors that manual review might miss while reducing the time required for quality control.

Payer-specific requirement databases ensure that claims meet unique submission requirements for different insurance companies. These databases are updated regularly as payer requirements change, helping practices stay current with evolving rules.

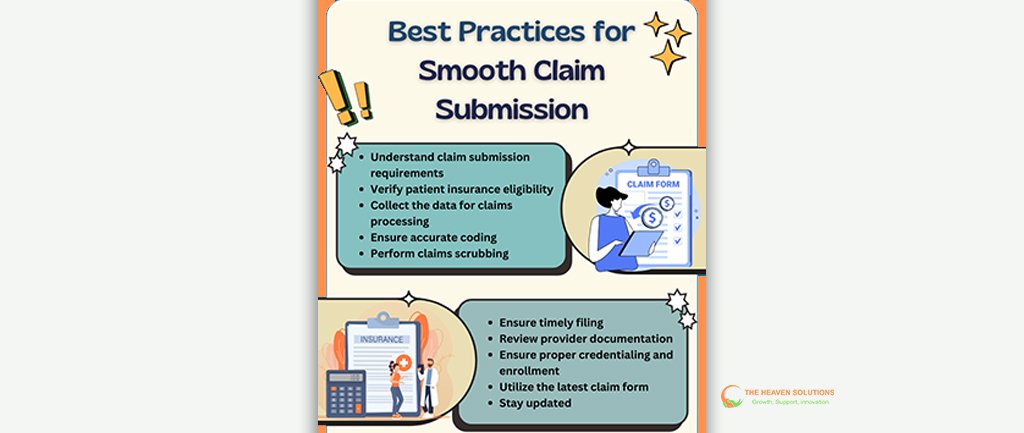

Best Practices for First-Pass Success

Mastering the submission process requires understanding the technical requirements, timing considerations, and payer relationships that determine claim processing success. What RCM in healthcare is becomes clear when you see how systematic submission processes accelerate payments.

Electronic vs. Paper Submission Strategie

Electronic submission provides significant advantages over paper claims in terms of speed, accuracy, and cost. Electronic claims are processed within 24-48 hours compared to 7-14 days for paper claims. RCM revenue cycle management systems support electronic submission through standard EDI (Electronic Data Interchange) transactions that most payers accept.

EDI transaction standards ensure that electronic claims are formatted correctly and contain all required information. The most common transaction types include 837P (professional claims), 837I (institutional claims), and various inquiry and response transactions for claim status checking.

Batch processing allows practices to submit multiple claims simultaneously, improving efficiency while maintaining quality control. Real-time submission may be appropriate for urgent claims or when immediate confirmation is needed.

Payer portal management involves maintaining access credentials, understanding portal-specific requirements, and managing different submission processes for different payers. Some payers require portal submission for certain claim types or prior authorizations.

Timing and Workflow Optimization

Optimal submission schedules balance efficiency with cash flow needs. Daily submission provides the fastest payment turnaround, while weekly submission may be more manageable for smaller practices. Healthcare revenue cycle management systems can automate submission schedules to ensure consistent, timely filing.

Workflow automation eliminates manual steps that create delays and introduce errors. Automated workflows can move claims through various approval stages, apply final edits, and submit claims without manual intervention.

Staff training and responsibility assignment ensure that submission processes are handled consistently regardless of staff schedules or availability. Clear protocols and backup procedures prevent submission delays when key staff members are unavailable.

Quality assurance checkpoints built into submission workflows catch last-minute errors and ensure compliance with all requirements. These checkpoints should include final eligibility verification, authorization confirmation, and compliance review.

Payer-Specific Considerations

Understanding unique payer requirements prevents rejections and delays. Commercial payers may have different requirements than government payers, and specialty services may face additional scrutiny or documentation requirements.

Commercial vs. government payer differences include varying documentation requirements, different prior authorization processes, and unique billing rules. RCM services must accommodate these differences while maintaining efficient workflows.

Relationship management with payer representatives can streamline problem resolution and provide advance notice of policy changes. Regular communication with payer contacts helps practices stay current with changing requirements and resolve issues quickly.

Stop letting revenue slip through the cracks. Contact The Heaven Solutions today for a free consultation and discover how our partnership can transform your practice’s financial health.

Systematic Approaches to Claim Tracking

Effective follow-up transforms unpaid claims into collected revenue. Revenue cycle management success depends on systematic tracking processes that ensure no claim falls through the cracks and every collectible dollar is pursued appropriately.

Establishing Tracking and Monitoring Systems

Aging reports and claim status monitoring provide visibility into claim processing progress and identify claims requiring follow-up. Reports should be generated daily and reviewed systematically to ensure timely action on delayed claims.

Follow-up schedules based on claim age and payer type optimize staff time while ensuring appropriate attention to different claim categories. High-priority claims may require follow-up within 7-14 days, while routine claims might be followed up at 21-30-day intervals.

Priority classification systems help staff focus on the highest-value activities. Claims should be prioritized based on dollar amount, payer type, claim age, and likelihood of successful collection. Medical revenue cycle management requires strategic resource allocation to maximize results.

Performance dashboards and reporting tools provide real-time visibility into key metrics and trends. Dashboards should display clean claim rates, denial rates, days in accounts receivable, and other key performance indicators that guide daily operations.

Effective Communication with Payers

Phone follow-up best practices include preparing for calls with complete claim information, understanding payer-specific procedures, and documenting all interactions thoroughly. Effective phone scripts help staff gather needed information efficiently while maintaining professional relationships.

Electronic inquiry systems using 270/271 transactions provide automated claim status checking that’s faster and more accurate than phone calls. RCM systems can submit these inquiries automatically and process responses to update claim status.

Written correspondence protocols ensure that written inquiries and appeals are professional, complete, and persuasive. Templates and standard procedures help maintain consistency while allowing customization for specific situations.

Documentation requirements for all interactions provide audit trails and support appeal processes. Every phone call, electronic inquiry, and written correspondence should be documented with dates, contacts, outcomes, and follow-up requirements.

Denial Management and Appeals Process

Systematic denial analysis and categorization identify patterns and root causes that can be addressed through process improvements. Denials should be categorized by reason, payer, provider, and service type to identify improvement opportunities.

Root cause identification and prevention focus on eliminating the sources of denials rather than just working on individual denial cases. Revenue cycle management in healthcare requires systematic analysis of denial patterns and implementation of preventive measures.

Appeal preparation and submission procedures ensure that appeals are complete, persuasive, and submitted within required timeframes. Appeals should include all necessary documentation, clear explanations of why payment is appropriate, and a professional presentation.

Timeline management and deadline tracking prevent appeals from being dismissed due to late filing. Different payers have different appeal timeframes, and missing these deadlines converts potentially collectible claims into permanent write-offs.

Common Claims Submission Mistakes and How to Avoid Them

Learning from common mistakes helps practices avoid expensive problems that delay payments and increase administrative costs. Revenue cycle management becomes clearer when you understand the pitfalls that trap many practices.

Documentation and Coding Pitfalls

Incomplete or insufficient clinical documentation remains the leading cause of medical necessity denials. Providers must document not just what they did, but why it was necessary for the patient’s condition. RCM cycle in medical billing success requires comprehensive clinical documentation that supports every service billed.

Common coding errors include using outdated codes, missing required modifiers, and failing to understand bundling rules. Regular training on coding updates and compliance requirements helps prevent these costly mistakes.

Medical necessity documentation gaps occur when clinical notes don’t clearly establish the relationship between patient symptoms, diagnoses, and treatments provided. Every service must be justified by clinical necessity, which is clearly documented in the medical record.

Modifier misuse and bundling problems can result in claim denials, reduced payments, or compliance issues. Understanding when modifiers are required and how bundling rules apply requires ongoing education and attention to payer policies.

Process and Workflow Failures

Inconsistent follow-up procedures allow claims to age unnecessarily and may result in missed filing deadlines. Systematic processes with clear responsibilities and timelines ensure that follow-up activities happen consistently.

Poor staff training and communication create knowledge gaps that lead to errors and inefficiencies. Healthcare RCM requires ongoing education as regulations, codes, and payer policies change frequently.

Technology integration problems can create data silos, duplicate work, and opportunities for errors. Comprehensive integration between clinical and billing systems is essential for efficient operations.

Inadequate quality control measures allow errors to reach payers, creating expensive rework and delays. Quality control should be built into workflows rather than treated as an occasional audit activity.

Timing and Compliance Issues

Missed filing deadlines convert collectible claims into permanent write-offs. Each payer has different filing deadlines, and tracking these deadlines across multiple payers requires systematic processes.

Authorization lapses and renewal failures can invalidate coverage for services already provided. RCM software should track authorization dates and alert staff before authorizations expire.

Regulatory compliance oversights can result in audits, penalties, and claim rejections. Staying current with changing regulations requires dedicated resources and systematic monitoring of updates.

Appeal deadline mismanagement is particularly costly because appeals typically have much shorter deadlines than original claim filing requirements. Missing appeal deadlines eliminates any opportunity to collect on denied claims.

Tools That Transform Claims Management

Modern technology transforms claims management from manual, error-prone processes into automated, efficient systems that accelerate payments and reduce administrative burden. Revenue cycle management technology provides capabilities that were impossible just a few years ago.

Practice Management System Integration

Comprehensive workflow automation connects every aspect of the revenue cycle process from patient scheduling through final payment. Integrated systems eliminate duplicate data entry, reduce errors, and provide real-time visibility into claim status and financial performance.

Real-time reporting and analytics provide insights that guide decision-making and identify improvement opportunities. Modern RCM systems can generate reports on demand and provide dashboard views of key performance indicators.

Integration with EHR systems ensures that clinical information flows seamlessly to billing systems without manual intervention. This integration is essential for accurate coding and comprehensive documentation.

Cloud-based solutions provide enterprise-level capabilities at costs accessible to smaller practices. Cloud systems also provide automatic updates, robust security, and remote access capabilities that support distributed work environments.

Specialized Claims Management Software

Advanced claim scrubbing capabilities check claims against thousands of rules and requirements before submission. These systems catch errors that manual review might miss while processing claims much faster than human reviewers.

Automated follow-up and tracking eliminate manual monitoring while ensuring that no claims are overlooked. Medical billing RCM systems can generate follow-up lists, submit electronic inquiries, and track responses automatically.

Denial management tools analyze denial patterns, prioritize appeals, and streamline the appeals process. These tools help practices focus their limited resources on the appeals most likely to succeed.

Performance analytics and benchmarking provide objective measures of improvement and identify areas needing attention. Healthcare revenue cycle management systems can compare practice performance to industry benchmarks and track trends over time.

Emerging Technologies and AI Solutions

Predictive analytics identify claims likely to be denied and suggest preventive actions. Machine learning algorithms analyze historical data to predict outcomes and recommend process improvements.

Automated coding assistance tools analyze clinical documentation and suggest appropriate codes. These tools improve coding accuracy while reducing the time required for manual code selection.

Machine learning for pattern recognition identifies trends and opportunities that human analysis might miss. RCM management systems using artificial intelligence continuously improve their accuracy and effectiveness.

Robotic process automation handles routine tasks like data entry, eligibility verification, and payment posting. This automation frees staff to focus on more complex activities that require human judgment and expertise.

Your Blueprint for Claims Management Excellence

Mastering claims submission and follow-up requires systematic approaches, proper technology, and ongoing commitment to excellence. The practices that achieve 95%+ clean claim rates and collect payments in 14-21 days don’t rely on luck they implement proven methodologies and maintain disciplined execution.

Revenue cycle optimization isn’t a one-time project but an ongoing process of measurement, analysis, and improvement. The healthcare industry continues to evolve, and successful practices adapt their processes to meet new challenges while maintaining operational excellence.

The financial benefits of mastering claims management are substantial. Practices that implement comprehensive healthcare revenue cycle management strategies typically see 30-50% reductions in days in accounts receivable, 60-80% reductions in denial rates, and 15-25% improvements in collection rates.

These improvements translate directly to improved cash flow, reduced administrative costs, and enhanced profitability. More importantly, they free up staff time and resources that can be redirected to patient care and practice growth initiatives.

The technology exists, the methodologies are proven, and the results are achievable. The question isn’t whether these improvements are possible it’s how quickly you’ll implement them and start seeing results.

Ready to transform your claims process and accelerate your payments? Contact The Heaven Solutions today for a comprehensive claims management assessment. Our proven methodologies help healthcare practices achieve clean claim rates above 95% while reducing payment cycles by 40%.

Don’t let inefficient claims processes drain your cash flow start your transformation today and secure faster, more predictable revenue. Your practice’s financial success depends on getting claims paid promptly and consistently. The solutions are available, the technology is proven, and the results are guaranteed.