RCM

5 Ways End-to-End RCM Outperforms In-House Billing

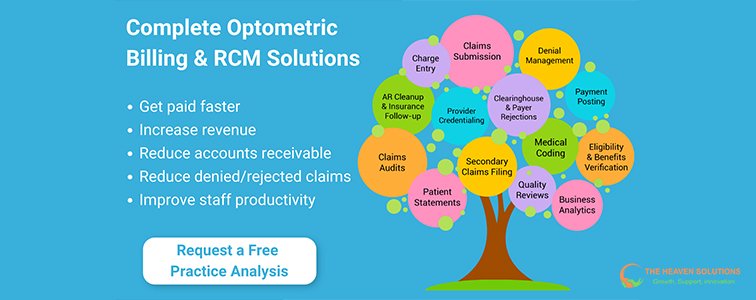

What’s Included

- Claims Management

- Denial Management

- Medical Coding & Billing

- Eligibility & Benefits Verification

- Payment Posting & AR Follow-Up

- Detailed Analytics & Reporting

Featured Post

The Top Denial Reasons by Insurance Payers and How to Boldly Outsmart Them

Every healthcare practice owner faces a critical decision: Should you manage your revenue cycle internally with your own staff, or partner with a specialized RCM company for end-to-end RCM service? The choice you make could be the difference between financial stability and constant cash flow struggles.

The two primary approaches to managing the revenue cycle in healthcare practices are maintaining an in-house billing department versus outsourcing RCM to a comprehensive provider. Each approach has distinct advantages and challenges that can significantly impact your practice’s financial health.

This post will provide a detailed comparison of both approaches across key factors like cost, efficiency, expertise, and scalability. By the end, you’ll understand which practices benefit most from each model and how to evaluate which option aligns best with your specific needs and goals.

Breaking Down the True Cost: In-House vs. Outsourced

When comparing in-house billing to outsourced RCM, most practice owners focus on the obvious expenses. However, the true cost of ownership includes hidden expenses that can dramatically shift the financial equation.

In-House Billing Costs

Managing your medical billing RCM internally involves multiple layers of expense that extend far beyond basic salaries. Direct expenses include staff salaries, benefits packages, ongoing training, and continuing education to keep up with changing regulations and coding updates.

Technology costs represent another significant investment. You need practice management software, clearinghouse fees, system updates, and technical support. The RCM systems required for effective billing are expensive and require regular maintenance and upgrades.

Overhead expenses add up quickly. Dedicated billing staff need office space, computers, phones, and administrative support. These operational costs are often overlooked when calculating the true expense of in-house billing.

Hidden costs can be the most damaging. Employee turnover in medical billing averages 20-25% annually, creating recruitment and training expenses. Sick days, vacation time, and productivity gaps during busy periods can disrupt your entire revenue cycle process. When your billing specialist is out sick, claims pile up and payments get delayed.

End-to-End RCM Costs

Revenue cycle management outsourcing typically involves service fees structured as either a percentage of collections or a flat monthly fee. This performance-based pricing model means your RCM service provider only succeeds when you get paid quickly and fully.

Outsourcing dramatically reduces your overhead. You eliminate the need for dedicated billing staff, specialized software licenses, and billing-related equipment. Your existing staff can focus on patient care instead of wrestling with complex RCM billing processes.

Cost predictability is a major advantage. Instead of variable expenses that fluctuate with employee issues or technology problems, you have fixed monthly expenses that make budgeting straightforward. Many practices find that outsourced medical billing costs 3-8% of collections, compared to in-house costs that often reach 8-15% when all factors are included.

Getting Paid Faster: Comparing Efficiency Metrics

The efficiency of your revenue cycle management directly impacts your cash flow and financial stability. Both approaches have strengths and weaknesses that affect key performance indicators.

In-House Efficiency Factors

In-house billing gives you direct control over processes and timelines. You can implement changes immediately and have face-to-face access to billing staff for questions or urgent issues. This control can be valuable for practices with unique procedures or complex billing requirements.

However, efficiency often suffers due to staff multitasking. Your billing person may also handle front desk duties, insurance verification, or patient scheduling. This divided attention increases the likelihood of errors and delays in the medical billing revenue cycle.

Vulnerability to disruptions is a major concern. When your billing specialist takes a vacation or calls in sick, your entire revenue cycle process can grind to a halt. Claims pile up, denials aren’t addressed promptly, and your accounts receivable ages unnecessarily.

End-to-End RCM Efficiency Factors

Healthcare revenue cycle management companies specialize exclusively in optimizing financial processes. They use advanced technology and automated workflows that many small practices can’t afford independently. These RCM systems include sophisticated claim scrubbing software, real-time eligibility verification, and automated denial management protocols.

Dedicated teams handle each aspect of the revenue cycle. Certified coders focus on accurate coding, billing specialists handle claim submission, and collection experts manage follow-up and appeals. This specialization typically results in higher clean claim rates and faster payment cycles.

Many RCM services operate around the clock, meaning your claims are processed and followed up on continuously. This 24/7 approach can significantly reduce your days in accounts receivable compared to in-house billing operations that work standard business hours.

The Knowledge Gap: Specialized Expertise vs. General Skills

The complexity of modern healthcare revenue cycle management requires specialized knowledge that’s constantly evolving. The expertise available through each approach can make or break your practice’s financial performance

In-House Expertise Considerations

Staff managing in-house billing often have broad knowledge but lack deep RCM expertise. Training costs for staying current with coding updates, regulatory changes, and payer requirements can be substantial. A single employee attending coding conferences, certification courses, and compliance training can cost thousands annually.

Limited exposure to industry best practices is common. Your in-house staff may only know your practice’s procedures, missing opportunities to implement proven strategies from other successful practices. They may not be aware of emerging trends in revenue cycle optimization that could improve your financial performance.

Scaling expertise as your practice grows presents challenges. Hiring additional qualified billing staff is expensive and time-consuming. Finding certified coders and experienced billing specialists in your local market can be difficult and costly.

End-to-End RCM Expertise Advantages

Outsourced RCM providers employ certified coders, billing specialists, and compliance experts who focus exclusively on healthcare revenue management. Their continuous training and certification maintenance is included in their service, ensuring your practice always benefits from current best practices.

These companies have experience across multiple specialties and payer types. They understand the nuances of different insurance companies and can navigate complex prior authorization requirements more effectively than generalist staff members.

Immediate scalability is a major advantage. Whether you’re adding providers, expanding benefits, or experiencing seasonal fluctuations, your RCM service can adjust resources quickly and efficiently. You don’t need to engage, train, or manage additional staff during busy periods.

Which Option Fits Your Practice? Key Decision Factors

Choosing between in-house billing and end-to-end RCM isn’t a one-size-fits-all conclusion. Your practice’s specific circumstances should guide this critical choice.

Practices That May Benefit from In-House Billing

Larger practices with sufficient volume can justify dedicated billing staff. If you’re processing hundreds of claims monthly and have the resources to hire multiple billing specialists, in-house billing may be cost-effective.

Practices with unique billing requirements or highly specialized procedures may benefit from in-house control. If your services require unusual coding or documentation that takes significant time to explain to outsiders, keeping billing internal might be advantageous.

Organizations that prioritize direct control over all operations sometimes prefer in-house billing. If your practice philosophy emphasizes complete internal management of all functions, this approach aligns with your values.

Practices with existing, high-performing billing teams should be carefully evaluated before changing. If your current revenue cycle management is efficient and cost-effective, major changes may not be necessary.

Practices That May Benefit from End-to-End RCM

Small to medium practices lacking specialized billing expertise are ideal candidates for outsourced medical billing. If you’re spending excessive time on billing issues or struggling with denials, RCM outsourcing can provide immediate relief.

Growing practices need scalable solutions. If you’re adding providers, expanding locations, or increasing patient volume, healthcare revenue cycle outsourcing can grow with you without the headaches of hiring and training additional staff.

Practices struggling with cash flow or high denial rates should seriously consider end-to-end RCM. Professional RCM services typically achieve cleaner claims and faster payments than struggling in-house operations.

Organizations wanting to focus entirely on patient care benefit most from outsourcing RCM. If administrative tasks are distracting from your clinical mission, experienced revenue cycle management services can free your team to concentrate on what they do best

Stop letting revenue slip through the cracks. Contact The Heaven Solutions today for a free consultation and discover how our partnership can transform your practice’s financial health.

Making the Right Choice for Your Practice

The “better” choice between in-house billing and end-to-end RCM depends on your practice’s size, resources, growth plans, and strategic priorities. Neither approach is universally superior; success comes from finding the right fit for your specific situation.

Evaluate your current billing performance honestly. Calculate your true cost per claim, including all hidden expenses. Review your clean claim rate, days in accounts receivable, and collection percentage. If these metrics are below industry benchmarks, RCM outsourcing may deliver immediate improvements.

Consider your future growth plans. If you’re planning to expand services, add providers, or open new locations, outsourced RCM provides the scalability to support growth without proportional increases in administrative overhead.

Assess your available resources realistically. If finding and retaining qualified billing staff is challenging in your market, or if your current staff is overwhelmed with multiple responsibilities, healthcare revenue cycle management companies can provide relief.

The importance of revenue cycle management cannot be overstated in today’s healthcare environment. Whether you choose in-house billing or end-to-end RCM, the key is implementing a systematic approach that maximizes collections while minimizing administrative burden.

Ready to explore which approach is right for your practice? Contact The Heaven Solutions for a free consultation and comprehensive analysis of your current revenue cycle performance. Our experts can help you understand the true cost and potential benefits of each option, ensuring you make the best decision for your practice’s financial future.